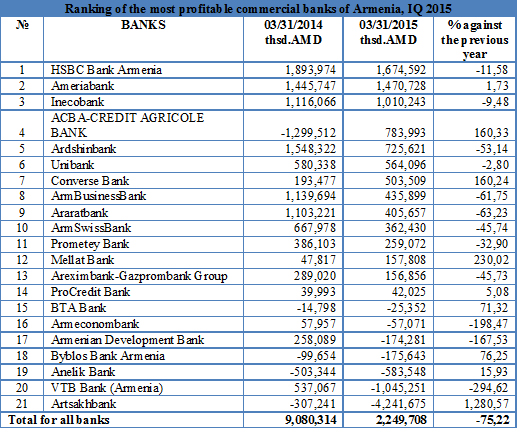

YEREVAN, May 15. /ARKA/. ARKA News Agency’s analysis shows that 14 of Armenia’s 21 commercial banks ended the first quarter of this year with profits. Their aggregate net profit amounted to about AMD 8.5 billion in the period, as compared to AMD 11.3 billion earned by 16 banks in the same period of 2014.

The remaining seven banks sustained losses totaling AMD 6.3 billion. It should be mentioned for comparison that in 2014 only five banks sustained losses, which totaled AMD 2.2 billion.

Net profits earned by the banks in January-March this year amounted to about AMD 2.2 billion, a reduction of 75.2% compared to the same period of 2014.

HSBC Bank Armenia, Ameriabank, Inecobank, ACBA-CREDIT AGRICOLE BANK and Ardshinbank are flagship banks in ARKA News Agency’s ranking. Their profit amounted to AMD 5.6 billion.

HSBC Bank Armenia, with its net profit amounting to AMD 1.67 billion and 11.58% decline in profits as compared to Q1 2014, is topping the ranking.

Ameriabank is the second with its profits amounting to 1.47 billion drams (1.73% increase).

Inecobank is ranked the third: its profits dropped by 9.48% to AMD 1 billion in the period.

Profits of the fourth bank in the ranking, ACBA-CREDIT AGRICOLE BANK, stood at AMD 783.9 million, as compared to AMD 1.29 billion in loss in the same quarter of the last year.

Ardshinbank came last in the ranking, with its profits having dropped by 53.14% to AMD 725.6 million.

The banks that sustained losses in the first quarter of this year are as follows: BTA Bank – AMD 25.3 million, Armeconombank – AMD 57 million, Armenian Development Bank – AMD 174.2 million, Byblos Bank Armenia – AMD 175.6 million, Anelik Bank – AMD 583.5 million, VTB Bank (Armenia) – about AMD 1 billion and Artsakhbank – AMD 4.2 billion drams.

Decline in banks’ profits is caused by difficult economic situation in general and by financial shocks due to dram depreciation (16.11% in the first quarter). It should be also noted that the central bank had to tighten the foreign currency reserve requirement for the banks to ease pressures in forex market. As a result, banks’ profits fell by 41% to AMD 27.1 billion.

The ranking is based on ARKA News Agency’s ‘Banks of Armenia’ Bulletin. For acquisition of the bulletin and the agency’s other products you should apply to the marketing unit (e-mail: [email protected]). –0–