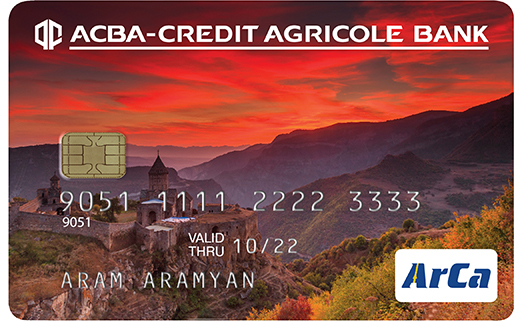

YEREVAN, October 3. /ARKA/. ACBA-CREDIT AGRICOLE BANK, one of the first partners of Russia’s payment system MIR, has issued ArCa-MIR new chip card, the press office of the bank reports.

According to the press office, the new card will be used as ArCa in Armenia’s territory and as MIR in Russia.

The new card ArCa-MIR will allow carrying out transactions in Russia’s territory on affordable terms.

The card can be used in 24/7 mode for operating fast transfers.

In particular, it will be possible to transfer money from Russia and receive it in a few minutes in Armenia and vice versa via ATMs with CASH-IN function at any time.

This round-the-clock money transfer service is possible thanks to the key and additional cards ArCa-MIR with a single account.

Entities transferring money can send it from Russia to their own card accounts, and recipients can withdraw cash by using their additional cards.

Remarkable is that ArCa-MIR card holders don’t have to pay service fee for the first year.

One of the characteristics of this card is its foreign exchange rate in transactions.

Unlike other payment systems, transactions here are made with the foreign exchange rate of the very day of the transaction, and this shields clients from forex market volatility.

MIR cards are already being serviced by ACBA-CREDIT AGRICOLE BANK’s ATMs, and as for POS terminals in service and trade centers, the bank is already extending the existing contracts and activating the service of MIR cards.

ACBA-Credit Agricole Bank was established in 1995 as part of European Union’s TACIS program. In September 2006, France’s Credit Agricole Group, investing a great deal in the bank’s capital, became its biggest shareholder. -0—-