YEREVAN, February 15. /ARKA/. Three major international rating agencies – Moody’s, S&P and Fitch have revised on Tuesday the rankings of several European countries and their banks. In particular, Moody’s Investors Service has downgraded the credit ratings of nine European countries, Standard & Poor’s and Fitch Ratings have lowered the ratings of leading Spanish banks.

Moody’s

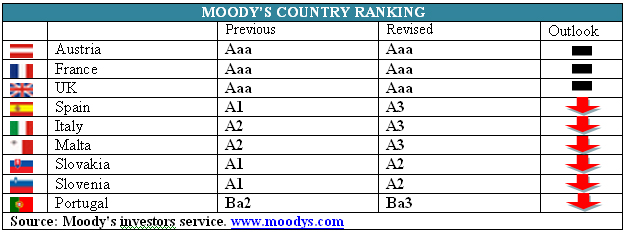

(Moody’s Country Ranking)

Moody’s has downgraded the rankings of countries burdened with large public debts and those with increasing susceptibility to financial and macroeconomic risks.

Long-term sovereign credit ratings of Spain has been reduced to the level of A3 from A1, Italy’s ranking has been was lowered to A3 from A2, Malta’s to A3 from A2, Slovakia’s to A2 from A1 and Slovenia’s- to A2 from A1, Portugal’s to Ba3 from Ba2. The rankings of Austria, France and Britain were affirmed at ‘AAA’, but the outlook was revised from “stable” to “negative.”

Moody’s analysts say Europe’s prospects for carrying out national projects to improve competitiveness and investment attractiveness are slashing. They also point out the uncertainty associated with the sources of funding to combat the crisis.

Standard & Poors

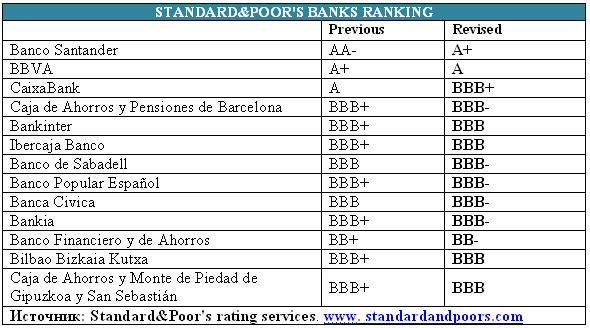

Standard & Poor’s has lowered the ratings of 15 leading Spanish banks. It has downgraded long-term and short-term ratings of one of the largest Banco Santander from A + to AA-, BBVA’s from A + to A. The outlook for all 15 banks is negative.

(S&P’s Banks ranking)

Standard & Poor’s has lowered the ratings of the banks after revising January 13 Spain’s long-term rating from A1 to A3. S&P’s analysts have revised downward BICRA (banking industry country risk assessment) indicator for Spain. It reflects the strengths and weaknesses of the banking system of the country compared to other countries’ systems, which also served as the basis for the revision of the rating of Spanish banks.

The outlook for another transnational bank Barclays Bank has been revised from “stable” to “negative”, by retaining the previous ranking – A/A-1. In addition to Spain, Standard & Poor’s has also lowered by two notches the long-term sovereign credit ratings of Italy, Cyprus and Portugal. The ratings of Austria, Malta, Slovakia, Slovenia and France were lowered by one notch.

Fitch

Fitch has downgraded the rankings of six major Spanish banks. Its experts predict that Spain will not see GDP growth in 2012. The outlook for 2013 is 1%. The unemployment rate will not change and remain at record 23%.

On the basis of pessimistic forecasts and the country’s inability to keep afloat the largest financial institutions, Fitch downgraded, in particular, long-term credit default rating for Santander and Banco Bilbao Vizcaya Argentaria (BBVA), which are the largest multinational banks. At the same time the rating of Santander was lowered by two notches and one notch for BBVA. -0-