YEREVAN, June 11. /ARKA/. Early last week gold quotes faced stable trading. Many members of London metal market were absent on the occasion of the state holiday of Great Britain. The investors chose awaiting course before the ECB regular session on interest rate and statements by Federal Reserve head Ben Bernanke. The stability in gold quotes was mainly justified by the fact that a slowdown in the U.S. and Europe’s economic growth may force central banks to roll out additional measures for softening monetary policy. Such measures may activate demand for gold as an asset for hedging risks of national currencies weakening.

On June 6, Wednesday, the metal was inclined for strengthening its position on the eve of ECB session. However, the results from the session didn’t make any surprise. The regulator’s board, as it was expected, left the main interest rate unchanged at 1%. Circumspect statements by ECB chairman Mario Draghi somehow tempered the expectations of the market members regarding the additional softening measures.

Gold quotes dropped significantly after the speech of the chairman of the Federal Reserve Ben Bernanke in the U.S. Congress. He didn’t signal on the early actions on softening monetary-credit policy. Fitch agency that downgraded the long-term rating of Spain to ВВВ with a negative forecast even worsened the situation.

On June 8, Friday, at the beginning of the world trade session, the quotes for the metal continued dropping due to the neutral position expressed by the chairman of Federal Reserve Ben Bernanke. However, throughout the American trading session gold could resume its losses in the wake of U.S. dollar’s falling.

As a result, gold prices tumbled by 1.46% to 1,593.07 USD per troy ounce.

This week, the gold quotes are expected to remain vulnerable as Spain is stuck in the uncertain situation, and the European regulator is unwilling to shore up significantly the financial sector. If Spain releases negative news the gold quotes may go on with shrinking. Strong U.S. dollar will also hinder rise in gold prices. The supporting benchmark for gold will be 1,550.0 USD per troy ounce this week.

The pressure can also be stopped by the awaiting position of the investors on the eve of elections in Greece on June 17, and if the economic data appears to be non-negative.

The forecasted macroeconomic statistics from the United States and the euro zone may also influence the dynamics of the precious metal on the coming week. Of the American data we should focus on industrial production, inflation for May, forecasted indicator of confidence reported by the University of Michigan for June, and a number of initial unemployment allowance applications for the last week. Of the European news we should highlight consumer prices index for May. The projected weak statistics from these regions may enhance the hopes of the investors for new measures related to economy stimulation thus supporting gold quotes. The resistance level for gold within the next five days may be 1,648.0 USD per troy ounce.

Copper prices last week slightly advanced to 3.3165 USD per pound. Earlier last week the prices went up due to the expectations that European and U.S. central banks will roll out additional measures for monetary policy softening.

The positive economic statistics on Australia’s GDP have also improved the sentiments of the investors. The indicator jumped by 1.3% in the first quarter from the previous quarter, and by 4.3% from the same period a year earlier, whereas many experts had projected growth by 0.7% and 3.4% respectively.

Drop of the interest rate in China, the world’s major metal consumer, also encouraged copper prices to grow.

People’s Bank of China stated that from June 8 the bank will decrease the annual loan interest rate and rate on credits by 25 points each.

However, at the week’s out the copper quotes were again pressured as the market members got disappointed by Bernanke’s comments concerning the economy stimulation. Strong U.S. dollar also pressured the quotes.

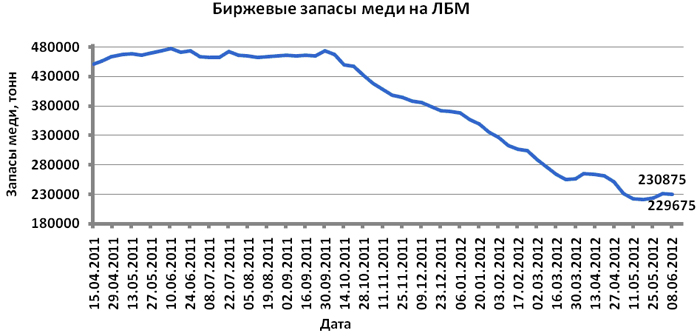

Slightly increased stock reserve of this asset in London Metal Exchange (LME) shored up the copper quotes .

.

Next week copper dynamics will mainly depend on U.S. and Chinese economic statistics, European events and USD dynamics. The U.S. industrial production indices are forecasted to report slowdown. In this case the quotes will be pressured.

However, if this statistics is positive, and the figures from Chinese industrial production and import for May are moderately positive, non-ferrous metals, including copper, will gain an impetus for growing. Anticipated fluctuation range of copper quotes on the futures market is 3.20 – 3.45 USD per copper pound coming week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. E.O.—0–