YEREVAN, September 10. /ARKA./. Last week gold prices rose significantly as speculations stated that the European regulator is not going to make non-limited purchases of government bonds and has no definite and official levels for yield . Nevertheless, as it was confirmed that the European regulator will sterilize its purchases, withdrawing from circulation equivalent amounts, gold prices growth got leveled.

On 7 September, Friday, gold prices reached their six-month maximum of 1,741.52 USD per troy ounce. This was after August’s rates of new jobs opening at the U.S. labor market slowed down thus enhancing hopes of investors that the U.S. Federal Reserve may additionally stimulate the economy. Indeed, according to the U.S. Department of Labor, the number of new job announcements in non-agricultural sector in August rose by 96,000 whereas many experts anticipated rise by 125,000.

The main currency pair climbed prompting increase in gold prices. As a result, gold prices jumped by 2.80% to 1,735.44 USD per troy ounce.

Early this week, the gold prices may face consolidation keeping the earlier positions. This week the investors will be interested in the next meeting of the U.S. Federal Reserve and press conference of its Chairman Ben Bernanke scheduled for Thursday, 13 September. We forecast that the American regulator may undertake actions to start the third round of qualitative softening. Several days before the meeting, the U.S. Federal Reserve Chairman Mr. Bernanke said at economic symposium in Jackson- Hall that the Federal Reserve must not exclude the possibility to use new cardinal measures to support the labor market and economy stimulus. If these measures are implemented, the gold prices may continue surging.

The resistance level for gold within the next five days will be 1,770.0 USD per troy ounce. Germany’s possible participation in ESM financing (the decision to be known on Wednesday, September 12) may also influence the sentiments of investors. According to our expectations, the Constitutional court of Germany will not make any surprising decisions, however, if the decision is negative, the gold prices may tumble significantly as the American currency will strengthen its positions disappointing the market participants.

Gold prices may also slip if the U.S. Federal Reserve doesn’t carry any stimulus measures. Thus, gold may fetch up 1,700.0 USD per troy ounce this week.

Copper prices rose by 5.47% to 3.6430 USD per pound. On Friday, copper reached its three-month and week maximum of 3.6525 USD per pound due to the investors’ hopes that the American regulator will soften monetary-credit policy.

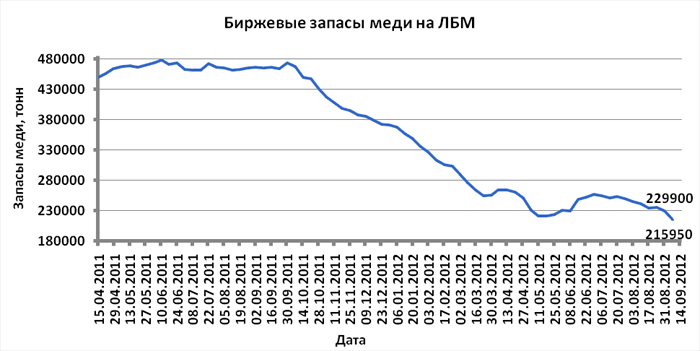

News on investments in China’s infrastructure development also raised copper quotes. The declining reserve of this asset at London Metal Exchange was also favorable for copper.

This week copper dynamics will mainly depend on the events in the United States, Eurozone and the economic data from China. We expect the U.S. Federal Reserve to undertake new measures on stimulus. Germany’s court decision on ESM participation will also support copper quotes. Investors will be also interested in foreign trade and industrial production of China for August, and the positive data may foster rise in copper prices.

However, if the statistics coming from China is not satisfactory, and the American regulator disappoints the investors, copper may dive. The expected fluctuation range for copper prices is 3.55 – 3.74 USD per pound.

The resistance level may be 3.85 USD per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. -0-