YEREVAN, October 1. / ARKA /. Last week gold traded unevenly in conditions of restrained activity. In the first half of the week its price fell on the wave of worries about global economic growth and intensifying concerns about euro zone debt crisis prompting investors to buy the greenback as a safe haven.

The ongoing protests against governments’ austerity measures in Spain and Greece also affected the activity of investors. Moreover, Spain was still delaying application for a full-scale financial aid, while Greece was waiting for international lenders to release the next tranche of financial aid. Against this backdrop, gold continued to decline until the middle of the week to $1.740.0. However, shortly afterwards buyers stepped up a little, pushing up prices. The positive background was secured by the speech of Chicago Fed President Charles Evans, who endorsed the latest program of the American regulator to buy bonds. Gold showed a significant growth on September 27, after the Spanish government submitted a draft budget for 2013 providing for a number of reforms aimed at reducing the budget deficit. As a result, the price of gold last week rose by 0.12% to 1.771.72 U.S. dollars per troy ounce.

This week a number of key economic data from the U.S. and the euro zone will be unveiled, which may have a significant impact on investor sentiment and the price of gold on the whole in October. We mean data on the number of new jobs from ADP and changes in non-farm payrolls for September. In addition, the U.S. Federal Reserve will publish the minutes of its latest meeting, which may shed light on the details of the third round of quantitative easing.

Of European news we would like to single out publication of the final data on PMI composite index for September, as well as the next ECB meeting on interest rates and the traditional press conference of its chairman Mario Draghi. According to our estimates, the European regulator will not present any surprises with regard to changes in the terms of monetary policy, which could have a positive impact on the gold price.

The anticipated moderately positive statistics from the United States may also show support for gold prices, which may rise to $1,800 per troy ounce. However, too optimistic data from the U.S. could strengthen the greenback and push gold price down to $1,740.

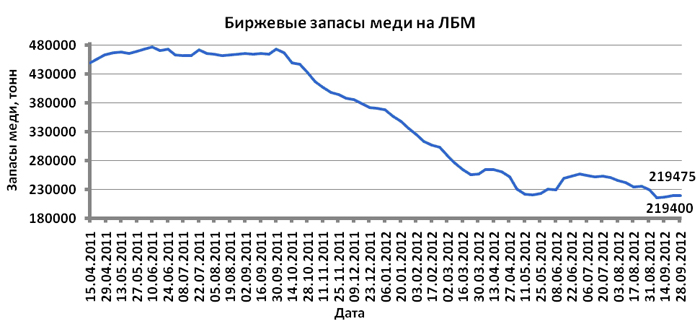

Copper futures price last week fell by 0.40% to $3.7535 per pound. Prices last week mostly declined due to increased concerns about the global economic outlook, as well as against the background of growing risks regarding the debt crisis in the eurozone. At the same time, weak economic data on U.S. GDP did not add optimism either.

The dynamics of copper this week will largely depend on the macroeconomic data from the U.S., the eurozone and China, as well as the dynamics of the U.S. currency, which are expected to be moderately positive. If these projections are correct, and the data for PMI index in USA and China appear to be moderately positive, non-ferrous metals, including copper, may resume growth. However, if this economic data failed to meet expectations, and the U.S. currency again resumes growth, copper may become cheaper falling to 3.85 USD per one pound.

Mikael Verdyan, analyst for GC FOREX CLUB, specially for ARKA.

The opinion of the author should not necessarily coincide with that of the agency.