YEREVAN, May 6./ARKA/. Gold prices were mainly rising last week, however, no stable dynamics was again reported. Physical purchases continued supporting the asset. In addition, mixed macroeconomic statistics of the largest economy and weaker positions of the USD made gold more attractive.

Nevertheless, the gold quotes were still varying within the former range. The market dealers were concerned about the contradictory statement released by the U.S. Federal Reserve that the stimulus program destiny will depend on the country’s economy. The U.S. labor market statistics has also worried the investors. As a result, gold prices climbed by 0.36% to 1,470.28 USD per troy ounce.

This week, gold quotes may either drop or consolidate as optimistic labor statistics from the USA dampened hopes of the investors over the stimulus program timeline. Nevertheless, the stable physical demand will curb huge slip in the gold quotes. The supporting benchmark this week will be 1,425.0 USD per troy ounce.

Gold dynamics will also depend on the macroeconomic statistics from the USA and eurozone. Of the American news, we should focus on labor market figures of the last week. Of the European news, we should highlight PMI for April, and monthly report of the ECB. Some weak statistics from the overseas and moderately positive one from the eurozone will support the gold quotes. The resistance benchmark this week may be 1,515.0 USD per troy ounce.

The gold prices will vary within 1,440.34 – 1,487.96 per troy ounce this week. According to the technical analyses, the gold quotes are still prone to falling in a short-term perspective.

Copper prices rose by 4.67% to 3.3035 USD per pound. The highest hike was recorded at the end of the week amid the physical purchases at low prices and better labor statistics of the USA. Nevertheless, Chinese low industrial statistics pressured the copper prices early last week.

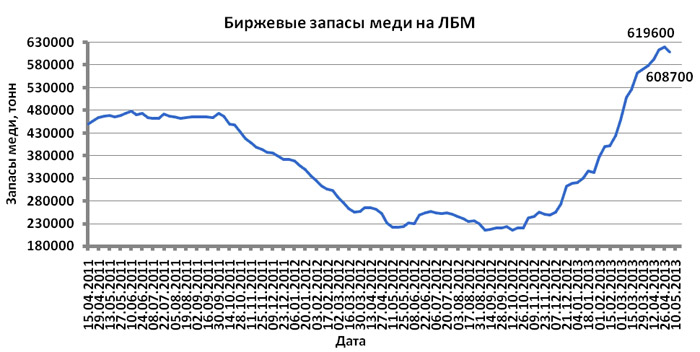

Decrease of the reserve of this asset at London Metal Exchange has also ensured an increase in the copper quotes.

Copper dynamics will mainly depend on the U.S. macroeconomic statistics, eurozone, China and USD.

The U.S. statistics is expected to be weak, this, in turn, will pressure the copper quotes. Moderately positive report of the ECB will, on the other hand, raise the quotes. If China releases positive foreign trade statistics, copper prices may also up.

However, if this statistics doesn’t come true, and the American currency again rises, the copper prices may tumble. The copper price may vary within 3.230 – 3.385 USD per pound this week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-