YEREVAN, January 26. /ARKA/. The housing question is one of the most fundamental of all social problems of Armenia’s citizens. People want to purchase a house or improve their living conditions and apply to banks which are practically the only source of receiving mortgage resources.

In order to shape a clear vision of the situation in the mortgage market of Armenia ARKA news agency attempted to develop a ranking of mortgage loans availability. This ranking is developed by ARKA based on international experience. Availability of mortgage loans is determined by three major criteria which are taken into account by borrowers when applying to a bank for a mortgage loan: the interest rate, the size of down payment and the maturity period.

Proceeding from this the agency has drawn up three ratings for each of the criteria. The agency has reviewed the terms applied by all 21 commercial banks operating in Armenia for provision of mortgage loans as of January 23, 2012.

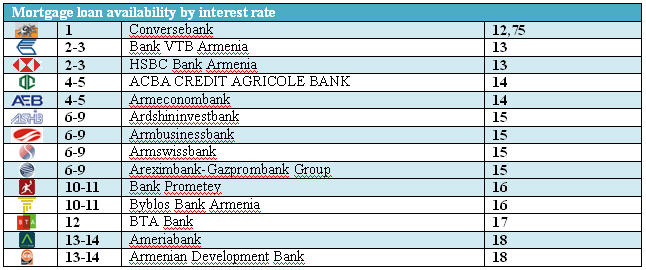

The ranking was compiled based on mortgage loans issued by banks in national currency from their own funds for purchase of a house. It takes into account maximum interest rate on mortgage loans. Accordingly, the banks which do not specify in their official websites the maximum interest rate are not included in it.

The banks which do not provide mortgage loans in drams from their own funds or are not engaged in mortgage lending are not included either. The ranking will be updated depending on changes in the terms of mortgage loans.

The rating in terms of loan interest rate availability includes 14 banks. As the table shows, the lowest interest rate is offered by Converse – 12.75%, which gives it the first position in the ranking. VTB Bank (Armenia) and HSBC Bank Armenia share the second and third places, offering a 13% rate. The top five also includes ACBA Credit Agricole Bank and Armeconombank whose rates are 14%.

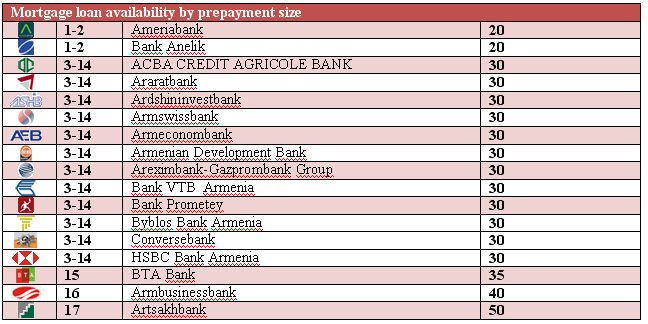

The rating in terms of down payment size includes 17 banks. The first two positions are shared by Ameriabank and Anelik Bank. These banks demand a 20% prepayment. The other twelve banks’ rate is 30%.

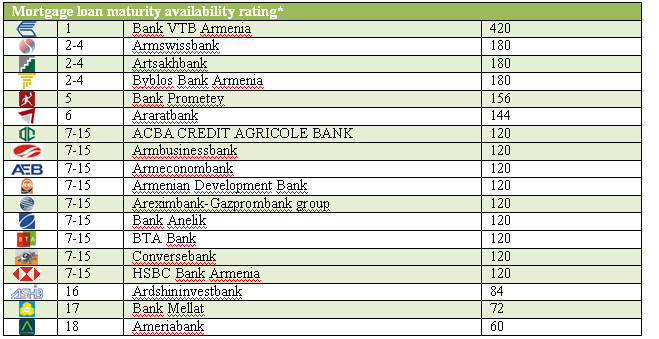

*data are for months

The first position in terms of maturity period is held by VTB Bank Armenia, which offers a maturity periods up to 35 years. The other three positions are shared by Armswissbank, Artsakhbank and Byblos Bank Armenia, which offer the maximum maturity of 180 months. The ratings were compiled on the basis of data posted on the banks’ official websites as of 23.01.2012. ARKA bears no responsibility for the reliability of the information on the websites.

This ranking is not a recommendation for seeking a mortgage loan in a particular bank and can not influence adoption of a commercial or other decision.-0-