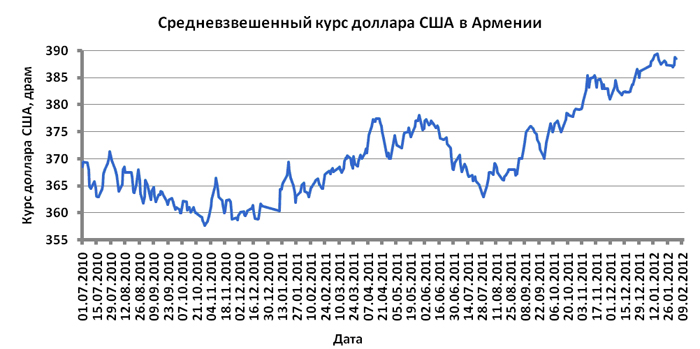

YEREVAN, February 8. /ARKA/. The U.S. dollar rose 0.32 percentage points to 388.50 drams at NASDAQ OMX Armenia last week.

Transactions effected at this stock exchange last week totaled $17.45 million – 4.77% less than those concluded here a week earlier.

The dollar climbed 0.61 points at Armenia’s forex market and traded at 390.30 drams on Saturday.

Market players continue viewing the U.S. dollar as a rescue currency amid fears prompted by slowdown in the global economy and its probable impacts on Armenia’s economy.

Greece’s likely default and the sovereign debt crisis that is looming large in the euro zone are spurring demand for the American currency in Armenia as well.

Importers’ high demand for the dollar and the dwindling flow of money transfers to Armenia, which is due to seasonal factors, will create a favourable ground for the dollar. However, the financial regulator’s probable interventions aimed at strengthening Armenia’s national currency, the dollar-dram exchange rate is thought to range between 387.0 and 394.0 drams per one dollar.

The population and business people’s growing demand for the American currency will contribute to the dollar’s.

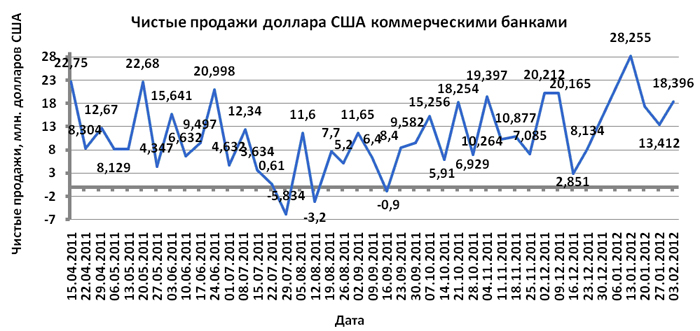

Indeed, according to the Armenian central bank’s review, commercial banks sold $18.396 million last week at intra-bank forex market – 37.16% week-on-week growth.

European currency’s value was determined by events at FOREX, the world foreign exchange market, where EUR/USD plunged 0.54% to 1.3145.

In the beginning of the last week the euro was going down, since market players were cautious ahead of the EU summit in Brussels. Greece’s failure to reach any accord with creditors and the increase of the yield of Portugal’s ten-year bonds over 15% put pressure on the European currency.

In the middle of that week the euro partially restored its value thanks to considerable progress reached in creation of closer budget union in Europe and the word of an agreement concluded by 25 countries’ leaders to establish a 500-billion stability fund.

Positive macroeconomic indicators which came from the euro zone added to EUR/USD upward movement as well.

Indeed, final data on European industrial sector’s PMI index was 48.8 in January against 46.9 in December.

Better-than-predicted figures on new jobs in the United States’ non-agriculture sector, which were released on Friday, had absolutely no impacts on the euro.

In Armenia, the euro added 0.8% to 515.65 drams due to the effect of the euro’s value in the country that lagged behind trade sessions at world forex market.

This gives grounds for thinking that the value of the euro will probably slip to 512.0 on Monday.

The euro value across the world and in Armenia will depend on economic developments the next week. The European regulator is believed to leave the current 1.0% refinancing interest rate unchanged.

If European Central Bank President Mario Draghi makes moderate positive outlooks at his traditional news conference on Thursday, the euro, perhaps, will continue its upward movement.

The euro is likely to be between 1.2950 and 1.3350 the next week at FOREX.

In Armenia, the euro is expected to be traded at 505 to 520 drams.

The Russian ruble rose 0.85% to 13.05 in Armenia over the last week mainly due to the dram’s devaluation against the U.S. dollar and stable value of the Russian currency against the dollar.

The ruble may gain in Armenia thanks to the expected devaluation of the Armenian dram against the dollar.

Macroeconomic news from the United States and developments in the euro zone will put additional pressure on the Russian currency. The Russian ruble may also be supported by world oil prices, which remain stably high because of tension over Iran.

Therefore, dram/ruble average exchange rate will range between 12.95 and 13.20 dram per one ruble in five trading days.

FOREX CLUB Analyst Mikael Verdyan, specially for ARKA News Agency

The author’s opinion does not necessarily coincide with the editorial board’s views