YEREVAN, March 19. /ARKA/. Gold prices slumped early last trading week to the new eight-week minimum of 1,634.39 USD dollars per troy ounce due to the news from the USA and USD dollar’s strengthening on FOREX international currency market.

Precious metal quotes dropped overcoming the key psychological level of 1,700.0 USD dollars after U.S. Federal Reserve unveiled its Tuesday, March 13, session’s outcomes on interest rate. The American regulator shattered hopes on new measures on quantitative easing against the background of the U.S. positive economic data of recent weeks.

At the same time risk reducing towards Euro zone’s debt issues also results in shrinking gold’s attractiveness as a safe-haven asset. The significant negative impact on the precious metal’s quotes was also caused by the data on Indian government’s possible decision to raise custom dues on gold. Nevertheless, the situation on the gold market changed for the better at the second half of the week. The precious metal was able to return its positions against the background of the principal currency pair’s strengthening as well as due to purchases at lower price levels.

As a result, the gold price fell by 3.06% to 1,659.66 USD dollars per troy ounce.

A slight rise or consolidation in gold prices can be expected next week as the investors consider significant upturn in U.S. February’s consumer prices as a positive factor for the precious metal market. Resistance level for gold can be 1,700 USD dollars per troy ounce next week. At the same time strong U.S. dollar will continue halting rise in gold prices.

The expected macroeconmic statistics from the USA and Euro zone can also have an impact on the precious metal’s dynamics. The main points of the American statistics are data on primary and secondary housing market in February and the number of primary applications for weekly unemployment benefits, as well as Ben Bernanke’s speech at the U.S. Federal Reserve’s conference. Amid European news it should be highlighted forecasted PMI composite index and business activity index in industrial sector in March.

If the economic statistic mentioned above despite positive forecast appears as negative and Bernanke’s comments disappoint the market participants once again, the gold prices may go on with dropping. Point of 1,615.0 USD dollars per troy ounce will be supporting for gold for the next five trading days.

Copper prices on the futures markets advanced 1.03% to 3, 8825 USD dollars per copper pound last week. One of the factors that touched off this upturn is American regulator’s statement on its intention to hold up mild monetary conditions till end-2014. U.S. recent macroeconomic statistics also upheld the red metal’s quotes.

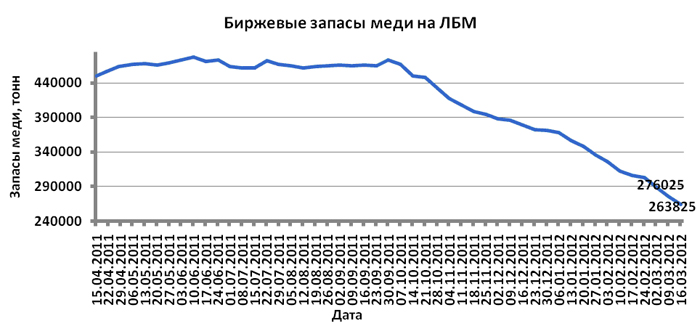

Additional supporting factor was decreasing stock reserve of this asset in London Metal Exchange (LME).

Next week copper dynamics will mainly depend on U.S. and Eurozone macroeconomic statistics as well as U.S. dollar’s dynamics. This statistics is expected to be moderately positive. If these forecasts are justified and data on primary and secondary housing market in the U.S. and business activity index in industrial sector are favorable as well as Mr. Bernanke’s comments are moderately positive, prices of non-ferrous metals, including copper, may continue rising.However, if this statistics doesn’t justify the hopes, and American dollar starts growing again, the copper prices may tumble. Anticipated fluctuation range of copper quotes on the futures market is 3.75-4.00 USD dollars per copper pound coming week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.