YEREVAN, November 27. /ARKA/. The European Bank for Reconstruction and Development (EBRD) has signed a funded Risk Sharing Framework (RSF) agreement with HSBC Bank Armenia (HSBC Armenia) to facilitate Armenian firms’ access to finance, EBRD said in a statement.

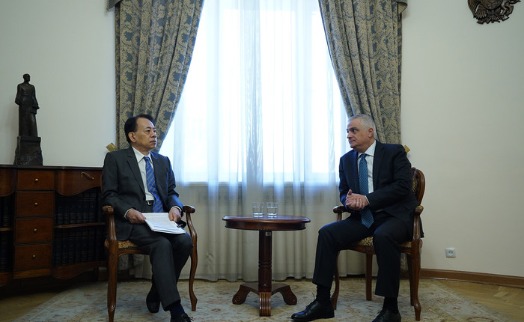

Under the agreement – signed today in Yerevan by Francis Malige, the EBRD’s Managing Director for Financial Institutions, and Irina Seylanyan, the HSBC Armenia’s Chief Executive Officer – the EBRD will co-finance individual loans provided by HSBC Armenia to eligible borrowers.

The RSF is one of three core financing frameworks of the EBRD’s Small Business Initiative, a programme dedicated to supporting and developing local private companies. The EBRD offers partner banks funded or unfunded risk participation mechanisms in foreign or local currency by co-financing and guaranteeing the partner bank’s loans to eligible companies.

“We are pleased to partner with HSBC Armenia to expand financing opportunities for growing companies. The EBRD’s risk-participation mechanism will enable HSBC Armenia to manage capital and risk concentration and facilitate credit growth for the benefit of the real economy,” said Francis Malige.

“This partnership marks a new chapter in our longstanding relationship with the EBRD. Through this collaboration, we look forward to enhancing our financing opportunities for local businesses,” said Irina Seylanyan.

HSBC Armenia is one of the EBRD’s key partner banks in Armenia, with cooperation particularly focused on supporting investments in sustainable energy. HSBC Armenia has distinguished itself as a leading provider of corporate and investment banking services in the country.

Bolstering firms’ competitiveness and supporting financial-sector intermediation through risk-sharing products are among the EBRD’s key priorities in Armenia. As one of the largest institutional investors there, the EBRD has invested more than €2 billion in 207 projects in the country, with the majority in the private sector. -0-