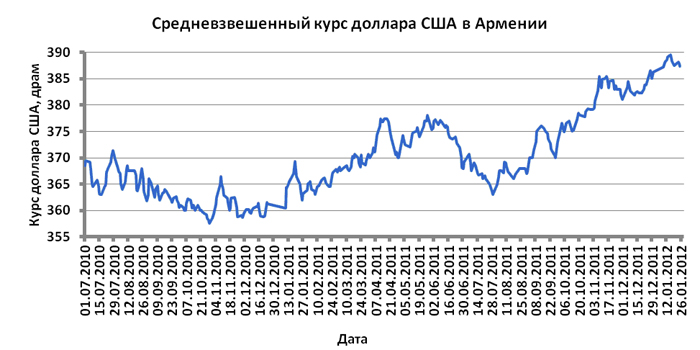

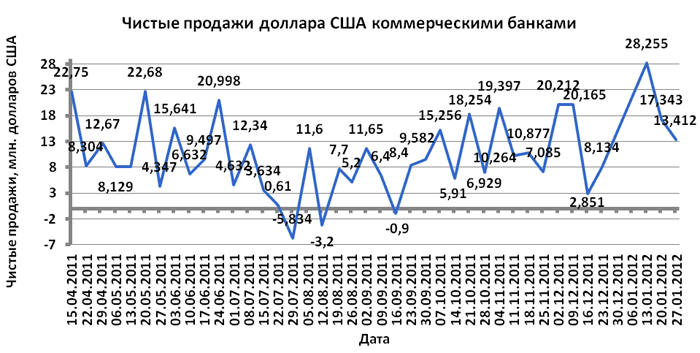

YEREVAN, January 30. /ARKA/. The average exchange rate of USD at NASDAQ OMX Armenia stock exchange last week dropped by 0.06% to 387.28 drams, as the overall weekly trading amounted to $18.325 million, a 37.78% increase compared to the previous week. The average selling rate of cash USD increased by 0.37% to 387.95 drams on January 28.

Against the background of reducing volume of remittances to Armenia, typical of this season the financial market is facing a shortage of foreign currency. To avoid the devaluation of the dram the Central Bank makes periodical intervention selling U.S. dollars. This was the main reason why market participants stopped short of making deals over the last two days.

The Central Bank will in all likelihood keep to this tactics this week too while the average selling rate of U.S. dollar will be in the range of 385 – 390 drams. This will also be assisted by diminishing purchases of U.S. dollars by individuals and businesses.

The euro exchange rate last week was determined by events at the global FOREX market, where the EUR/USD rose 2.2% to 1.3216. Euro’s exchange rate jumped up after the U.S. regulator announced its intention to maintain the current low refinancing rate at 0-0.25% until the end of 2014. As a result, the average selling rate of euro cash in Armenia last week rose by 1.05% to 511.58 drams.

If the regular economic statistics remains negative, Euro exchange rate at FOREX is likely to fall to 1.3050. In this regard, the average selling rate of euro cash in Armenia this week will be between 505.0-520.0 AMD.

The average selling rate of the cash Russian ruble last week rose by 2.7% to 12.94 drams. This was due to increase in the value of the ruble against U.S. dollar against the background of improved feelings in financial markets, as well as consistently high oil prices due to conflict with Iran. Price of a barrel of Brent crude oil last week rose by 1.4% to 111.55 U.S. dollars.

The cost of the ruble against the U.S. dollar and, consequently, to the dram this week will depend on the emerging macroeconomic statistics in the U.S. and oil prices. The ongoing conflict with Iran and that country’s intention to cut off oil supplies to Europe may push up prices of oil and the value of Russian ruble. The average selling rate of the cash ruble in Armenia over the next five trading days is likely to be in the range 12.65- 13.20 drams.

Michael Verdyan, an analyst of FOREX CLUB, specially for ARKA.

The opinion of the author may not necessarily represent that of the agency.