YEREVAN, February 13. /ARKA/. On the first day of trading last week gold has shown a weak downward trend. Quotes of gold metal dropped due to caution of market participants in regard with the fact that over the weekend, Prime Minister of Greece was unable to find a compromise with leaders of political parties on additional measures to reduce expenses necessary for getting the second package of financial assistance amounting 130 billion.

However on Tuesday, on February 7, the situation in the gold market has changed better.

The precious metal was able to recover its position after the optimism about the fact that political parties in Greece are probably close to a consensus on the pact of financial assistance. Moderately positive comments of U.S. Federal Reserve Chairman Mr. Bernanke in his speech before the Senate Budget Committee also supported the growth of gold. Bernanke once again hinted at the further tendency of soft monetary-credit policy.

From Wednesday, February 8 until the end of the last week, gold traded lower as the news about the delayed negotiations in Greece worsened the mood of investors. The speech of the Chairman of European Central Bank (ECB) Mario Draghi also contributed to the worsening of the news after the decision on interest rates which he pointed to downside risks for the economy of eurozone. It was also noted that inflation in 2012 will probably slow down to the level of the central bank. In the light of these developments, attractiveness of gold declined.

As a result, the gold price last week reduced by 0.25% to 1721.25 USD per troy ounce.

This week the focus of market participants will be the outcome of the meeting of Greek Parliament where additional austerity measures will be discussed. If the two parties of Greek government coalition could manage to approve the agreement with EU, the quotes of the precious metal may be resumed. Resistance level for gold in the upcoming week could be 1765.0 USD per troy ounce.

Planned macroeconomic statistics from the U.S. and eurozone can affect the dynamics of precious metal next week. From the American news is worth paying attention to the index of consumer prices, change of the production volume and figures of housing market in January, as well as publication of the protocol of the last Federal Reserve meeting on January 25. From European news it is worth selecting publication of data on the index of mood in the business environment in Germany by the institute ZEW for February, as well as preliminary data on GDP for the forth quarter of 2011.

If the above mentioned economic statistics will be negative, and the Greek Parliament fails to agree on the agreement with EU, gold may continue to decline. Support for gold in the next five trading days will be the mark of 1680.0 USD per troy ounce.

Copper price in the futures market next week decreased by 1.25% to 3.8560 USD per one pound of copper. The reason for this was the mood of investors in global financial markets late last week and poor economic data from China. Really, the data on import to China in January occurred significantly worse than expectations of many experts – the indicator reduced by 15.3% annually vs. forecasted 3.6%. Data on consumer price inflation also disappointed the investors, thus weakening the hopes of softening monetary-credit policy in China. Thus, contrary to expectations, inflation in January rose from 4.1% to 4.5% in annual terms.

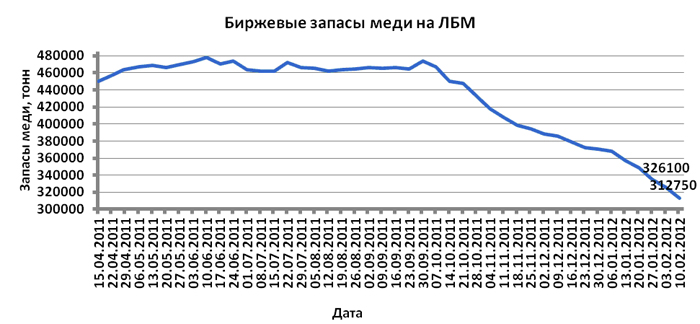

Support factor for red metal last week became declining stock of reserve assets on London Metal Exchange (LME).

Copper dynamics next week will depend on economic news from the U.S. and eurozone. In particular, statistics on industry and real estate market in the U.S., as well as GDP volume of eurozone in the forth Q. If the economic indicators show a positive trend, the cost of copper may rise to 4.00 USD per pound.

In case, if macroeconomic data from these two countries will appear disappointing, and the Greek parliament will not be able to carry out an agreement with EU, copper price may be reduced to the mark 3.70 USD per pound of copper. —0–

Mikayel Verdyan, analysts of Forex Club

YEREVAN, February 13. /ARKA/. On the first day of trading last week gold has shown a weak downward trend. Quotes of gold metal dropped due to caution of market participants in regard with the fact that over the weekend, Prime Minister of Greece was unable to find a compromise with leaders of political parties on additional measures to reduce expenses necessary for getting the second package of financial assistance amounting 130 billion.

However on Tuesday, on February 7, the situation in the gold market has changed better.

The precious metal was able to recover its position after the optimism about the fact that political parties in Greece are probably close to a consensus on the pact of financial assistance. Moderately positive comments of U.S. Federal Reserve Chairman Mr. Bernanke in his speech before the Senate Budget Committee also supported the growth of gold. Bernanke once again hinted at the further tendency of soft monetary-credit policy.

From Wednesday, February 8 until the end of the last week, gold traded lower as the news about the delayed negotiations in Greece worsened the mood of investors. The speech of the Chairman of European Central Bank (ECB) Mario Draghi also contributed to the worsening of the news after the decision on interest rates which he pointed to downside risks for the economy of eurozone. It was also noted that inflation in 2012 will probably slow down to the level of the central bank. In the light of these developments, attractiveness of gold declined.

As a result, the gold price last week reduced by 0.25% to 1721.25 USD per troy ounce.

This week the focus of market participants will be the outcome of the meeting of Greek Parliament where additional austerity measures will be discussed. If the two parties of Greek government coalition could manage to approve the agreement with EU, the quotes of the precious metal may be resumed. Resistance level for gold in the upcoming week could be 1765.0 USD per troy ounce.

Planned macroeconomic statistics from the U.S. and eurozone can affect the dynamics of precious metal next week. From the American news is worth paying attention to the index of consumer prices, change of the production volume and figures of housing market in January, as well as publication of the protocol of the last Federal Reserve meeting on January 25. From European news it is worth selecting publication of data on the index of mood in the business environment in Germany by the institute ZEW for February, as well as preliminary data on GDP for the forth quarter of 2011.

If the above mentioned economic statistics will be negative, and the Greek Parliament fails to agree on the agreement with EU, gold may continue to decline. Support for gold in the next five trading days will be the mark of 1680.0 USD per troy ounce.

Copper price in the futures market next week decreased by 1.25% to 3.8560 USD per one pound of copper. The reason for this was the mood of investors in global financial markets late last week and poor economic data from China. Really, the data on import to China in January occurred significantly worse than expectations of many experts – the indicator reduced by 15.3% annually vs. forecasted 3.6%. Data on consumer price inflation also disappointed the investors, thus weakening the hopes of softening monetary-credit policy in China. Thus, contrary to expectations, inflation in January rose from 4.1% to 4.5% in annual terms.

Support factor for red metal last week became declining stock of reserve assets on London Metal Exchange (LME).

Copper dynamics next week will depend on economic news from the U.S. and eurozone. In particular, statistics on industry and real estate market in the U.S., as well as GDP volume of eurozone in the forth Q. If the economic indicators show a positive trend, the cost of copper may rise to 4.00 USD per pound.

In case, if macroeconomic data from these two countries will appear disappointing, and the Greek parliament will not be able to carry out an agreement with EU, copper price may be reduced to the mark 3.70 USD per pound of copper. —0–

Mikayel Verdyan, analysts of Forex Club