YEREVAN, March 7. /ARKA/. The Armenian Development Bank has announced a new offer for its customers which is available until May 31. The offer is a new type of term savings deposit called Maximum. The bank said in a press release that deposits will be accepted for a period of 2 years at an annual rate of 14% in Armenian drams, 10% in U.S. dollars and 8% in euros.

According to the report, the minimum and maximum amounts of deposits are 500 thousand and 50 million drams respectively or equivalents in foreign currency.

Anna Ananyan, head of customer service department of the bank, was quoted as saying that the deposit has no analogues in the banking system and is attractive not only because of high interest rates. She says the depositors are allowed to partially reduce the amount of the deposit, while receiving higher interests.

The report also notes that in 2011 ADB has recorded an unprecedented 115% growth in the volume of term deposits or 11.7 billion drams. The volume of private deposits grew by 2.2 times, while the number of depositors surged by 2.3 times.

According to Ananyan, the current approaches of the bank in the context of its deposit policy stem from 2011 indicators, and its new positioning at the market.

‘We attach special importance to providing our customers with possibilities to gain more revenue and creating for them more convenient and favorable conditions,” Ananyan says.

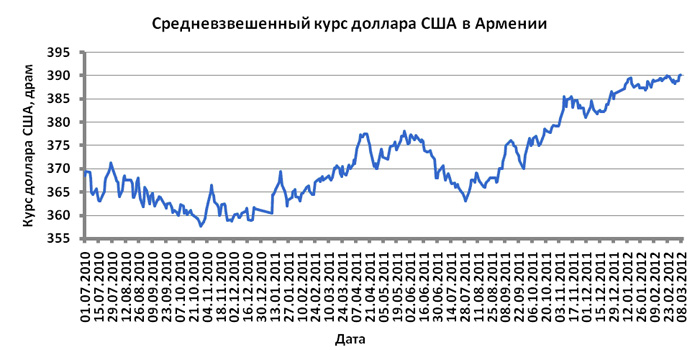

The Armenian Development Bank (ADB) was established in 1990. Prior to 1996 it operated as the Bank of Reconstruction and Development. Its major shareholders are Ruben Hayrapetyan – 19.98%, Ara Mehakyan – 16.95% and Grigor Termenjyan – 16.03%. ($1 – 388.87 drams).-0-