YEREVAN, March 12. /ARKA/. Gold price fell in the beginning of the last trading week to the new six-week minimum of 1,663.40 USD dollars per troy ounce due to the news from China and Euro zone, and current uncertainty related to Greece’s debt write-off.

Chinese government downgraded economic growth forecast for 2012 from 8% to 7.5%. Economic statistics on February business activity index and forth-quarter GDP of Euro zone were also disappointing. Indeed, business activity index in February was 49.3 against anticipated 49.7 thus reporting slump in economic activity. And the reviewed index of Euro zone’s 2011 -forth-quarter GDP dropped by 0.3% from a quarter earlier.

Nevertheless, the situation in the gold market changed for the better in the second half of the week. Precious metal could get back its positions after Greek debt restructuring had received an optimism. Data compiled from U.S. labor market for February, and published on March 9, Friday, first resulted in a short-term drop in gold prices. However, gold prices rose on Friday. As a result gold prices remained unchanged last week, 1,711.97 USD dollars per troy ounce.

Market participants will focus on the results of EU Finance Ministers’ planned session in Brussels early next week, on which the officials are expected to decide on the first tranche of financial aid to Greece within the second international program. Positive decision can uphold the growth of precious metal’s quotes. Resistance level for gold can be 1,763.0 USD dollars per troy ounce next week.

The planned macro-economic statistics from the USA and Euro zone can also influence the dynamics of precious metal this week. What refers to the U.S. news the attention should be focused on consumer price index and industrial production’s volume change as well as U.S. Federal Reserve’s another session on principal rate. In European news it’s necessary to highlight the data on sentiment indicator in business in Germany published by ZEW institute in March, and also consumer price inflation in February.

If the economic statistics, mentioned above, despite positive forecast becomes negative, and the EU Finance Ministers are unable to decide on aid to Greece, the gold price can restart its tumble. Point of 1,660.0 USD dollars per troy ounce will be supporting for gold for the next five days.

Copper prices in the futures market dropped by 1.55% to 3,8430 USD dollars per copper pound last week. This was caused by deterioration in investors’ sentiment in futures market due to uncertainty in writing off Greece’s debt to private creditors as well as unfavorable Chinese economic growth forecast.

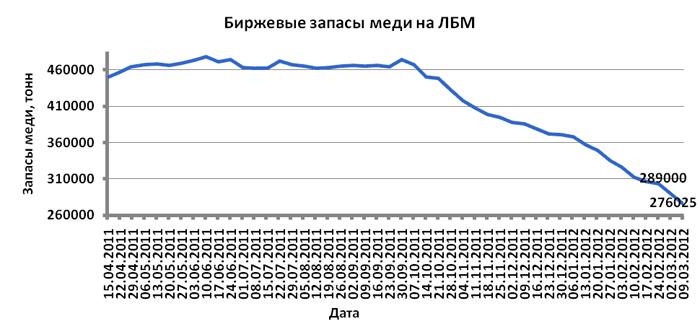

Nevertheless, copper quotes partially re-established their losses. The most significant growth of the red metal’s quote was reported on March 9, Friday, after positive news from U.S. labor market for February. Additional supporting factor was decreasing stock reserve of this asset in London Metal Exchange (LME).

Positive data on imports from China, published on March 10, Saturday, will possibly uphold copper quotes. This index reported a year-increase by 39.6% in February against anticipated 31.8%. If the forecasts come true and economic statistics from the USA and Euro zone is moderately positive, copper prices can rise up to 4.00 USD dollars per pound. And in case the macro-economic statistics from these two countries is disappointing, and EU Finance Ministers are unable to make decision on the first tranche of financial aid to Greece, copper price can fall to 3.70 USD dollars per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.