YEREVAN, April 16. /ARKA/. Last week, gold made an attempt to reverse the downtrend on hopes of a soft monetary policy of the U.S. Federal Reserve. At the beginning of the reporting period, gold buying was triggered by adverse information from the U.S. labor market, published on April 6. Another factor was the news that the jewelers in India ended a twenty-day strike in protest against new taxes on gold trade.

Cautious statements by Mr. Bernanke in a speech in Atlanta that further regulatory measures may be required also contributed to the rise of gold price. Nevertheless, weak first quarter GDP data for China and consumer price inflation in the U.S. significantly changed the moods in the market, and at the end of the week prices came under pressure. As a result, the price of gold increased by 1.7% to $1,657.94 per troy ounce. This week the price may rise to $1.695.0.

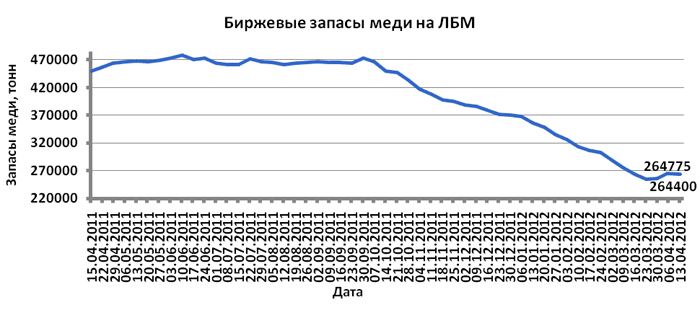

The cost of copper in the futures market last week fell by 4.75% to 3.616.5 U.S. dollars per pound on concerns of investors about the worsening global economic outlook and situation in the euro area, as well as appreciation of the U.S. currency.

Dynamics of copper price this week will largely depend on the macroeconomic statistics from the U.S. and the euro zone, as well as the dynamics of the U.S. currency. It is expected that these statistics will be moderately positive. If these predictions come true, and data on industrial production and the U.S. housing market, as well as the sentiment index in the business environment in Germany are moderately positive, non-ferrous metals, including copper, can recover their losses.

However, if such statistics do not justify the hopes and the U.S. currency will continue to rise again, copper may fall in price to 3.50 – 3.75 USD per pound.

Mikael Verdyan, an analyst at Forex Club.

The opinion of the author may not necessarily represent those of the agency