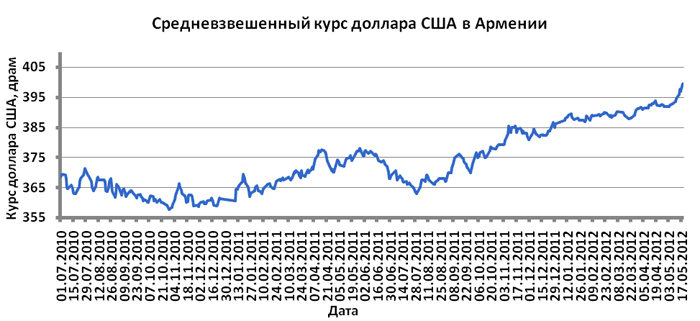

YEREVAN, May 21. / ARKA /. Last week the cost of USD at NASDAQ OMX Armenia stock exchange grew by 1.28% to 399.50 drams as overall weekly trading amounted to $17.0 million, a 52.84% increase over the previous week. The average selling rate of cash greenback rose by 1.40% to 401.29 Drams on May 19.

The growth was due to ongoing demand for foreign currency, as well as to the growth of U.S. dollar at international currency markets. The U.S. currency is viewed by foreign exchange market participants in Armenia as a haven currency, possibly because of concerns about slowing global economy and its implications for the local economy. A possible exit pf Greece from the eurozone and extension of the debt crisis to other countries in the euro zone are also increasing the demand for U.S. currency in Armenia.

This week, in view of a possible intervention of the regulator to maintain the national currency’s exchange rate, the average selling rate of cash U.S. dollar in Armenia will be in between 398.0 – 405.0 drams.

According to the Armenian Central Bank reports, net sales of foreign exchange by commercial banks last week totaled $15.449 million, which was 43.21% more than in the previous week.

Throughout last week, the rate of the single European currency was under pressure as another attempt to form a coalition government in Greece failed, prompting investors to refrain from buying risky assets. Ten-year Spanish bond yield rose to 6.35%, reaching the highest level since December last year.

Greece is facing new elections, and therefore the country could lose the financial support of the international community. Reduced profitability of Spanish government bonds also contributed to the growth of the euro. Weak economic data from the U.S. also helped to improve sentiments. As a result, the average selling rate of cash euro in Armenia last week decreased by 0.43% to 512.04 drams.

The anticipated range of volatility in the Euro FOREX market this week is 1.2600-1.2950 and this in mind the average selling rate of cash euro in Armenia will probably be within between 505 – 525 drams.

The average selling rate of cash Russian ruble last week declined by 1.52% to 12.95 drams due to depreciation of the ruble against the U.S. dollar against the backdrop of a slight drop in oil prices.

The cost of the ruble this week will depend on the emerging macroeconomic statistics from the U.S. and the euro area, as well as on the dynamics of oil prices. This in view the average selling rate of cash ruble in Armenia over the next five trading days is likely to be between 12.85 – 13.10 drams. -0-

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.