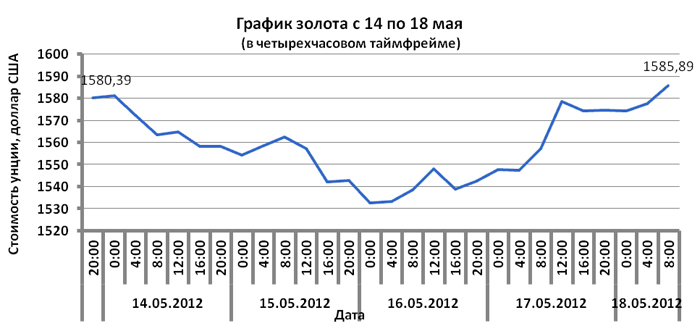

YEREVAN, May 21. /ARKA/. Gold prices took a sharp dive in the beginning of last week after another attempt to form a coalition government in Greece failed prompting investors to be cautious and refrain from buying gold.

New shocks at lending markets in European periphery drove gold prices down as well. Indeed, yield of Spain’s ten-year bonds rose to 6.35% hitting the record high since December 2011.

Gold was going down in three consecutive trading days plunging to the record low since the beginning of this year – it traded at $1527.04 dollars per one Troy ounce as fears over the euro zone debt problems remained and the U.S. dollar kept strengthening.

Greece is still in the spotlight. The country is heading towards new elections and because of this it may lose financial support of the international community. This explains why investors worried about potential aftereffects of this scenario sought to buy the greenback, which impacted gold price.

Nevertheless, gold rose from its low by the end of the week as French and German government securities auctions produced positive results.

Fallen yield of Spanish government bonds fueled gold’s upward motion as well.

Philadelphia Federal Reserve’s weak macroeconomic statistics on business activity index pushed gold price up as well, since these data strengthened market players’ hopes for U.S. Federal Reserve’s further mitigation steps.

As a result, gold rose 0.042% over the week to $1585.89 per once. Strength of the U.S. currency will continue barring gold from rising.

Gold may be traded at $1635.0 per one ounce in the coming five days.

Moderate positive information expected from the United States and the euro zone may have favorable impact on gold prices.

However, if news from the U.S. labor market and Germany’s expectations index are adverse, gold may resume its downward motion.

U.S.$1540.0 an ounce price may support gold the next week.

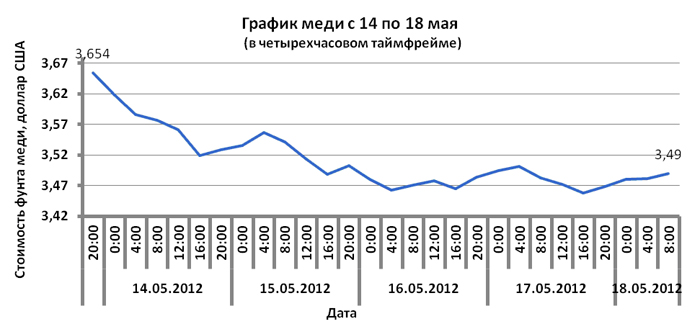

Copper price on futures market fell 3.83% over this week to $3.4900 per one pound of copper.

Prices this week were going down because of rising fears over Greece’s possible exit from the euro zone and worries about Spain’s banking sector.

Weak economic data on expectations index in Germany and business activity index in the United States added no optimism triggering sales of the red metal.

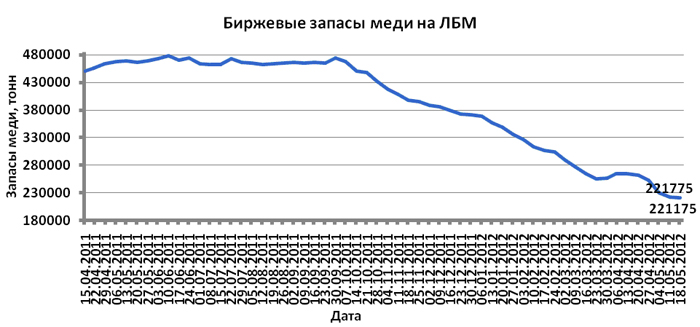

Copper stock that slightly reduced at London Metal Exchange supported copper prices last week.

This week’s precipitous plunge in copper prices may attract buyers laying favorable ground for a rally the next week. But the rally will be hobbled by the remaining uncertainty over things in the euro zone. If the situation worsens copper price will keep sinking.

Copper price will also be impacted by macroeconomic statistics fro, the United States and the euro zone.

The red metal price is expected to fluctuate between $3.39 and 3.62 per pound.

Mikael Verdyan, analyst at Forex Club

The opinion of the author does not necessarily reflect that of the agency