YEREVAN, September 10. /ARKA/. Last week the U.S. dollar’s average weighted exchange rate at NASDAQ OMX Armenia stock exchange climbed by 1.17% to 412.79 drams with weekly trading amounting to USD 7.15 million, 33.49% lower from a week earlier. The average selling rate of cash dollar increased by 0.89%, to 413.68 drams as of Saturday, September 8. This dynamics of USD in Armenia is prompted by the high demand for this currency coming from importers and the population amid the dram devaluation.

We expect USD dynamics to depend on the next meeting of the U.S. Federal Reserve. The American currency will further grow if the American regulator doesn’t announce on launching a new stimulus. An average USD exchange at NASDAQ OMX Armenia may fetch up 411.0 – 416.0 drams if the Regulator supports its national currency.

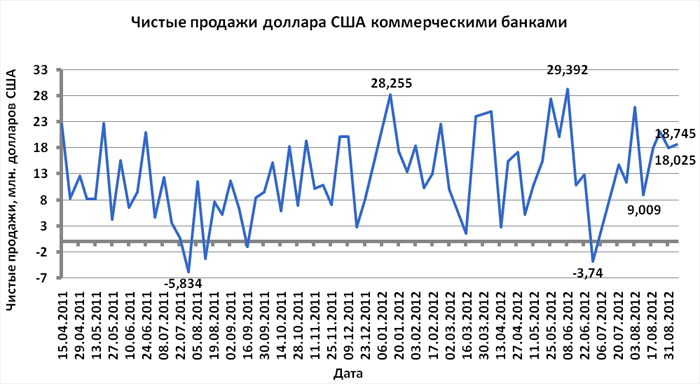

The dollar may also rise due to the growing demand for it from the population and business. Indeed, according to the Central Bank of Armenia, the banks sold 18.745 million dollars last week, that is 4.0% higher from a week earlier.

Euro rates in Armenia depended on FOREX market, where EUR/USD jumped by 1.88% to 1.2814 amid the expectations that the European regulator will announce on the additional measures directed to easing the tense situation around the government bonds of Italy and Spain.

On 7 September, Friday, the euro got a significant impetus for rising following the weak economic data from the U.S. labor market indicating that the American regulator is ready to apply to economy additional stimulus. Indeed, according to the U.S. Department of Labor, the number of new job announcements in non-agricultural sector in August rose by 96,000 whereas many experts anticipated rise by 125,000.

As a result, an average weighted selling rate of euro cash in Armenia advanced 2.07% to 528.49 drams.

Euro dynamics will mainly depend on economic data from the USA and the Eurozone this week. Of American news we should focus on the next meeting of the U.S. Federal Reserve and press conference of its Chairman Ben Bernanke scheduled for Thursday, 13 September. We forecast that the American regulator may undertake actions to start the third round of qualitative softening.

Several days before the meeting, the U.S. Federal Reserve Chairman Mr. Bernanke said at economic symposium in Jackson- Hall that the Federal Reserve must not exclude the possibility to use new cardinal measures to support the labor market and economy stimulus. If these measures are implemented, the euro quotes may continue rising.

Of European news we should highlight Germany’s possible participation in ESM financing (the decision to be known on Wednesday, September 12). According to our expectations, the Constitutional court of Germany will not make any surprising decisions, however, if the decision is negative, the euro may tumble significantly as the American currency will strengthen its positions disappointing the market participants.

The euro may also slip if the U.S. Federal Reserve doesn’t roll out the stimulus measures. The anticipated euro fluctuation range at FOREX in Armenia this week will be 1.2580 – 1.3000. The average selling rate of cash euro in Armenia this week will likely be in the range of 520 – 540 drams.

The average selling rate of cash Russian ruble last week climbed by 2.34% to 13.15 drams due to ruble’s increase against USD amid hopes for the U.S. Regulator’s actions, and tumble of the Armenian dram against USD.

The cost of ruble against USD this week will be depending on U.S. macroeconomic statistics and Eurozone, as well as oil prices dynamics. The expected positive decision by Germany’s constitutional court on ESM financing participation may strengthen the ruble’s positions. If the American regulator disappoints, the ruble may tumble.

The average selling rate of the ruble in Armenia is likely to be in the range of 13.00 – 13.30 drams.

Mikael Verdyan, an analyst for FOREX CLUB, specially for ARKA.

The opinion of the author may not necessarily represent those of the agency.—0–