YEREVAN, October 29. /ARKA/. Last week quotes for precious assets, including gold, significantly slashed amid the U.S. strengthening. As a result, gold quotes reached a new seven-week minimum of 1,698.81 USD per troy ounce.

The new concerns about the situation in Spain and Greece, as well as weak economic data of Germany forced the investors to buy the U.S. currency, as an asylum currency.

Prospects for the growth of the fourth largest economy of the eurozone and its financial situation came to the limelight after the Spanish regulator informed the recession in the third quarter may get even worse. In addition, Moody’s downgraded Catalonia and four other regions of Spain, discouraging the investors. The report presented by the three largest international creditors didn’t cast any optimism on the matter, as it stated that Greece would need additional 30 billion euros by the end of 2016 to offset the deeper than projected recession, and budget goals implementation deferred for 2 years.

Nevertheless, gold quotes attempted to rise last mid-week as the U.S. Federal Reserve released a statement on monetary-credit policy, which met investors’ expectations. Eleven out of twelve Federal Reserve directors voted for sustaining stimuli measures to accelerate labor market rally. The falling USD and careful purchases at low prices have also fostered climb in gold quotes.

On Friday, October 26, the gold quotes were again traded under the pressure at slightly over 1,700.0 USD per troy ounce. However, during the American trading session gold prices partially offset amid the U.S. GDP positive data that encouraged the investors. As a result, gold prices tumbled by 0.37% to 1,711.10 USD per troy ounce.

This week, the analysts expect a slight increase or consolidation in the gold cost. However, a stable investment and physical demand will be required to make the growing dynamics steady. The concerns about the uncertain situation in Europe and the strengthening USD will continue pressuring gold prices.

The gold prices dynamics will depend on the macro economic statiscits of the U.S. and the eurozone. Of the American statistics we should focus on consumer confidence index, PMI index, new job vacancies announced by ADP agency, and the number of the employed in a non-agricultural sector in October.

Of the European news we should highlight the preliminary consumer prices index in Germany and the eurozone, the final figures of consumer confidence index and PMI for manufacture sector in October. The expected moderately positive statistics will prompt hikes in gold prices. The resistance level for gold in the next five days may be 1,735.0 USD per troy ounce.

However, if the eurozone releases worse than projected data, and the U.S. statistics appears to be very optimistic, gold quotes may slip. The supportive level for gold may be 1,684.0 USD per troy ounce.

Copper cost slashed by 1.81% to 3.5580 USD per pound due to macroeconomic factors, the strong USD, and weak data from Germany.

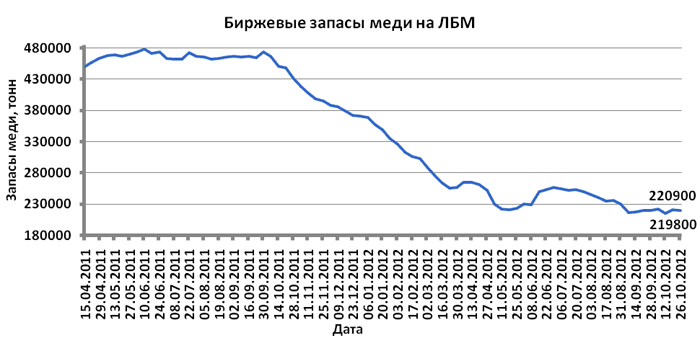

Copper prices rose, however, as the principal currency pair enhanced its positions. Slightly decreased reserve of this asset at London Metal Exchange also supported copper quotes.

This week copper dynamics will mainly depend on the macroeconomic statistics of the United States, eurozone and the USD. If the data are optimistic, the copper quotes will go up.

The expected fluctuation range for copper prices is 3.47 – 3.63 USD per copper pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. —0-