YEREVAN, December 17. /ARKA/. Last week the gold quotes were pressured amid the political battles between the U.S. legislators over the so-called “budget breakdown,” expenditures cuts and tax increases to be embarked early next year.

Furthermore, the investors got concerned as House Speaker John Boehner stated President Obama’s budget proposals were not balanced, and the White House seemed to put the economy into the fiscal cliff.

Moreover, the new stimuli measures by the U.S. Federal Reserve didn’t cast any optimism. At the same time, more optimistic data than expected from the U.S. labor market pressured the gold value as well. As a result, gold prices dropped by 0.58% to 1,694.37 USD per troy ounce.

This week, the gold quotes may remain vulnerable as the concerns arise around the U.S. “budget breakdown.” Moreover, little time left for submitting amendments to the Congress to prevent it from approving the new harmful tax laws.

By the end of the week, the investors will have become more passive as this week will be the last full trading one on the eve of the holidays. The supporting benchmark for gold may be 1,683.34 -1,663.0 USD per troy ounce.

Gold dynamics will depend on the macroeconomic statistics from the U.S. and the eurozone. Of the American statistics we should focus on the final U.S. GDP for the third quarter, economic activity published by Chicago Federal Reserve, consumer expenses, durable goods orders, and the labor market for November. Of the European news we should highlight business environment of Germany published by IFO for December. The expected moderately optimistic statistics from overseas and optimistic data from the eurozone may foster gold quotes hike. The resisting benchmark for gold this week will be 1,721.0 USD per troy ounce.

Copper price last week rose 0.15% to 3.6715 USD per pound due to more optimistic data on industrial production and PMI for industrial sector from China, and strong position of the main currency pairs.

Nevertheless, the investors continued limiting their deals amid the discussions of the U.S. legislators.

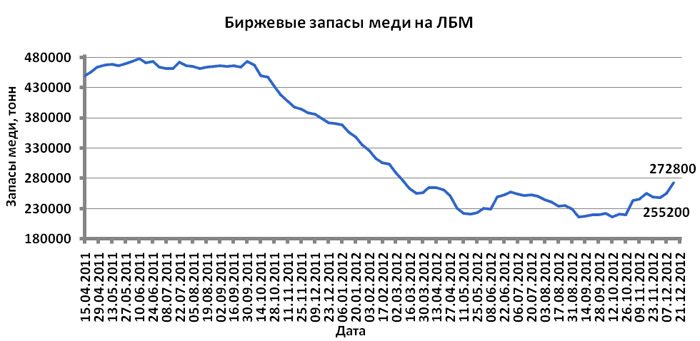

The increased reserve of this asset at London Metal Exchange also prevented hike in copper quotes.

This week copper dynamics will mainly depend on the macroeconomic statistics of the United States and the eurozone.

The American statistics is expected to be moderately optimistic, thus copper prices will grow.

The anticipated fluctuation range for copper is 3.60 – 3.73 USD per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. .—0-