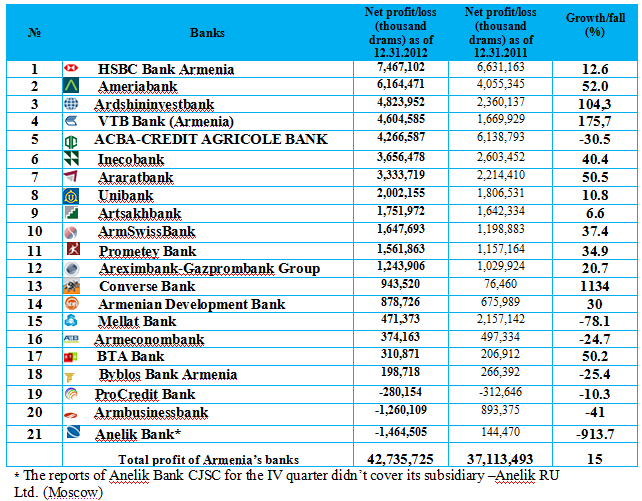

YEREVAN, March 14. /ARKA/. ARKA agency has released its annual Top Profitable Banks of Armenia rating 2012.

It is noteworthy that Armenian banks operated successfully last year, and 18 out of 21 banks posted profits. The net profit of the banks shot up by 15.1% in 2012 year over year to nearly 42.7 billion drams, and the loss of three banks stood at about 3 billion drams. In 2011 the loss at 312.6 million drams were reported just by one bank.

ARKA ranked HSBC Bank Armenia as the leading bank in the net profit (over 7.4 billion drams). In 2011 this bank was also first in the rating. The net profit of HSBC Bank Armenia in 2012 climbed by 12.6% from a year earlier.

Ameriabank follows HSBC Armenia with the 6.1-billion-dram profit, an increase by 52% from 2011. ARKA ranked this bank the fourth in 2011.

The third position in the rating is given to Ardshininvestbank. The bank’s net profit amounted to 4.8 billion drams rising twice year over year. In the previous rating the bank took the seventh position.

VTB Bank (Armenia) dropped from the third position in 2011’s rating to the fourth in the current ranking. Its net profit valued at nearly 4.6 billion drams. It is said to jump 2.8 times from 2011.

ACBA-CREDIT AGRICOLE BANK appears on the fifth position in the current ranking falling from 2011’s second position. The bank’s net profit dove by 30.5% to 4.2 billion drams year over year.

The highest growth of the net profit was recorded by Converse Bank –12.3 times to 943.5 million drams versus 76.4 million drams in 2011. Artsakhbank posted the lowest growth of its net profit at 6.6% (1.8 million drams).

Despite the hike in the aggregate net profit in 2012, six banks earned less from 2011. In addition, the loss of one of the banks dropped last year.

The rating was filed on the basis of the data provided by ARKA’s “Banks of Armenia” bulletin.

For more information refer to “Banks of Armenia” quarterly bulletin prepared on the basis of unified financial reports of banking organizations and additional information of the banks published in the press.

Bulletin “Banks of Armenia” contains 60 pages of tables on banking indicators and 9 main chapters characterizing the banking system: 1.General characteristics of the banks. 2. Assets. 3. Liabilities. 4. Capital. 5. Income/Loss. 6. Information of the movement of monetary means. 7. Level of liquidation and capitalization. 8. Normative indicators of risks. 9. Indicators of profitability of the banks.

Please, contact Marketing Department in case you are interested in the bulletin or some other news products of ARKA agency (e-mail: [email protected]). -0-