YEREVAN, July 10. / ARKA /. None of 21 Armenia-based banks was included in the list of one hundred largest banks in the CIS, prepared by RIA Ranking. To be placed in the list a bank should have at least $2.57 billion worth assets. The threshold was up by 21% from 2011, when it was $2.12 billion).

ACBA-CREDIT AGRICOLE BANK, the largest Armenian bank by size of assets in 2012 had only $613 million worth assets which made 10.3% of total banking assets in the reporting period, which stood at about $6 billion.

According to RIA Ranking, Armenia’s banking sector is characterized by relatively low consolidation, the main reason why no Armenian bank appeared in the list. No banks from Kyrgyzstan, Moldova and Tajikistan were included in the rating either.

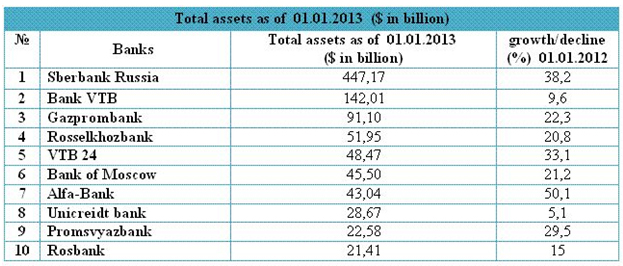

The largest banks are in seven CIS countries: Azerbaijan, Belarus, Georgia, Kazakhstan, Russia, Ukraine and Uzbekistan. Georgian banks were included in the list despite the fact that Georgia withdrew from CIS in 2009, because of their close links with CIS banks. By the way, 69 of 100 largest banks are in Russia.

According to RIA Rating, the total assets of the banking systems in the CIS increased in 2012 by 23.1% to $1.96 trillion. At that the net assets of the one hundred largest banks grew to 1.52 trillion rubles. They accounted for around 81 percent of all assets in the CIS banks at the beginning of 2013.

According to RIA Ranking experts, the growth in CIS banks assets will slow down to about 10-15% in 2013 denominated in USD .