YEREVAN, March 23. /ARKA/. ARKA News Agency has issued the 2014 asset ranking of credit organizations.

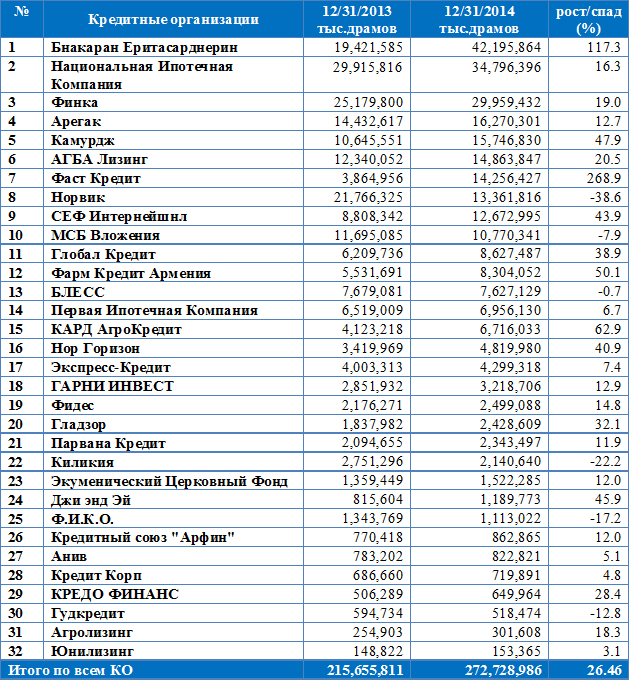

The agency’s analysis shows that the aggregate assets of Armenia’s 32 credit organizations amounted to AMD 272.7 billion in 2014 showing 26.5% growth, compared with the previous year.

Bnakaran Yeritasardnerin Universal Credit Organization, the National Mortgage Company, Finca Universal Credit Organization, Aregak Universal Credit Organization and Kamurj Universal Credit Organization were singled out in the ranking for the largest assets, which totaled AMD 139 billion in 2014 and made up 51% of the aggregate assets of all the credit organizations of the country.

Bnakaran Yeritasardnerin, with its AMD 42.2 billion, is topping the ranking. The company almost doubled its assets over that year. Its share in the assets of Armenia’s credit organizations was 15.5%.

The National Mortgage Company was the second biggest asset-owner among the country’s credit organizations in 2014. The company has built up its assets 16.3% over 2014 to about AMD 34 billion. Its share in teh aggregate assets was 12.8%.

Finca, with about AMD 30 billion built up 19% over the year and 11% share, came third in the ranking.

Aregak ranked fourth. Its assets increased by 12.7% to AMD 16.3 billion and made up 6% of the total assets of the country’s credit organizations.

Kamurj, with its AMD 15.7 billion, 47.9% growth and 5.8% share, ranked fifth.

ARKA News Agency’s analysis also shows that Fast Credit Universal Credit Organization showed the highest asset growth in 2014. Its assets grew 3.7 times over the year to AMD 14.3 billion (the seventh position in the ARKA ranking).

Norvik Universal Credit Organization faced the most dramatic decline – its assets shrank 38.6% over the year to AMD 13.4 billion (the eighth rank).

Unileasing Credit Organization was singled out in the 2014 ranking for the smallest amount – AMD 153.4 million, though, its assets grew 3.05%, compared with 2013. Its share in Armenian credit organizations’ aggregate assets was 0.06% in 20147.

The ranking is based on ARKA News Agency’s ‘Credit Organizations of Armenia 2014’ Bulletin.