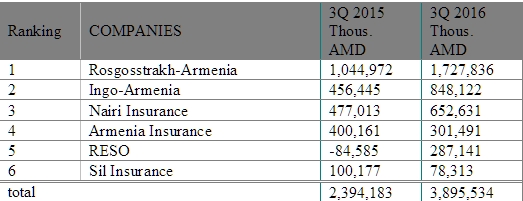

YEREVAN, November 16. /ARKA/. The net profit of six Armenia-based insurance companies in the first 9 months of 2016 amounted to 3.895.5 billion drams, up from 2.394.1 billion drams they had earned in the same period of 2015, an increase of 62.7%., according to ARKA news agency’s bulletin “Insurance Companies of Armenia” for the third quarter of 2016.

All 6 companies worked with a profit. The leading insurance company by size of net profit was Rosgosstrakh-Armenia, which earned 1.727.8 billion drams, up from 1.044.9 billion drams it had earned in the first 9 months of 2015.

It was followed by Ingo Armenia that earned 848.1 million drams in net profit (a year-on-year growth of 85.8%), Nairi Insurance with a profit of 652.6 million drams (36.8% growth), Armenia Insurance -. 301.4 million drams (a decline of 24.7%), RESO – 287.1 million drams (in quarter 3 of 2015 it sustained losses to the tune of 84.5 million drams) and Sil Insurance – 78.3 million drams (a drop of 21.8%).

The combined assets of the six companies in the first 9 months amounted to 42 billion drams (a growth of 8.2%); their liabilities stood at 22.7 billion drams (a growth of 0.7%) and their capital grew by 18.6% to 19.3 billion drams. ($ 1 – 478.90 drams) 0-