YEREVAN, February 10. /ARKA/. Vardan Aramyan, Armenian finance minister, thinks the increase in the foreign debt servicing burden is unlikely to put additional pressure on the Armenian dram.

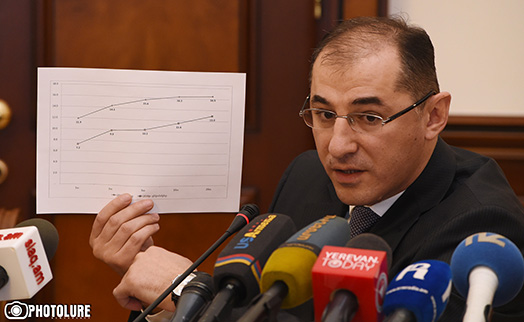

He told journalists on Thursday that the country’s current account deficit narrowed from 8% to 2.8%.

In his words, in such countries as our country, the acceptable deficit ranges between 4 and 5%. “In addition, when imports shrink, demand for foreign currencies goes down as well,” he said. “And as for ability to service the foreign debt, it should be taken into account that the Armenian market receives financing from various sources – exports, money transfers and borrowings.”

Asked whether the government intends to issue bonds to cover budget spending or not, the minister said that this is a permanent process.

“But if you speak about placement of government bonds worth $300 million at the foreign market, no such scenarios are being considered now,” he said.

Aramyan confirmed that the peak of foreign debt repayment will come in 2020, when Armenia will have to pay $500 million.

Armenia’s public debt amounted to about $5.9 billion in late 2016. Of this amount, $1.1 million is domestic debt. –0—