YEREVAN, February 17. /ARKA/. ARKA News Agency’s ranking of the most profitable credit organizations of Armenia for 2016 is already available.

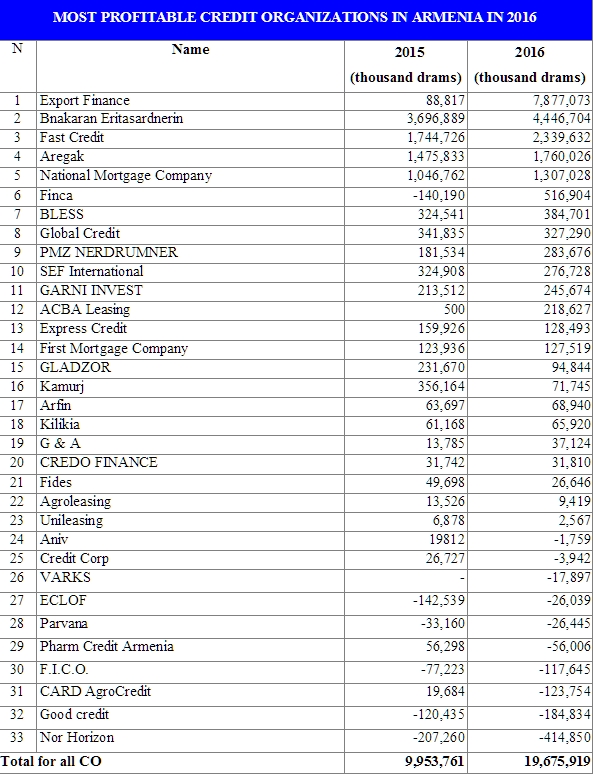

The news agency’s analysis shows that the credit organizations of the country have doubled their aggregate net profits from AMD 9 953 million in 2015 to AMD 19 675 million in 2016.

Of Armenia’s 33 credit organizations, 23 ended the year with profits (total amount of their profits was AMD 20 649 million) in 2016 while the remaining ten sustained losses totaling AMD 973.2 million against AMD 720.8 million lost by six credit organizations a year earlier.

Export Finance, Bnakaran Eritasardnerin, Fast Credit, Aregak and National Mortgage Company are topping the ranking.

Export Finance was the biggest profit-gainer among Armenia’s credit organizations in 2016, and CARD AgroCredit is singled out in the ranking for the largest losses – AMD 123.7 million, while in 2015 the latter earned AMD 19.6 million in profit and came 31st in ARKA News Agency’s ranking. .

There are 34 registered credit organizations in Armenia, but actually 33 of them operate.

The ranking is based on ARKA News Agency’s ‘Credit Organizations of Armenia’ Bulletin. M.V.—0—