YEREVAN, July 15. /ARKA/. Armenia registered a high indicator of financial stability, and the demand for government bonds exceeded supply 2.7 times, Artak Manukyan, the MP from the ruling faction My Step, said Wednesday an extraordinary parliamentary session.

In his words, in the current circumstances of the aggression manifested by Azerbaijan, the reaction of financial markets to what is happening is very important.

“Confidence in financial markets reflects the situation and stability in the country, which can be judged by the placement of government bonds,” Manukyan said.

He said that yesterday Armenia and Azerbaijan issued government bonds, and the demand for Armenian securities was 2.7 times higher – about 60 billion drams were placed, despite the fact that demand was 2.7 times more and demand for Azerbaijani securities – 5 times lower.

The lawmaker stressed that Armenia issued bonds with a maturity of 9 years (maturity until 2029), while Azerbaijan only for a year.

“The longer the term of government bonds, the higher yield investors expect. However, the yield on nine-year Armenian bonds and one-year Azerbaijani bonds is the same. This is clear evidence that we will gradually succeed not only in the development of the army, but also in other areas,” Manukyan said proposing to independently draw conclusions from the data presented.

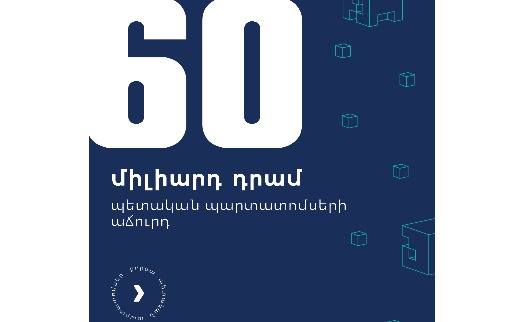

On July 14, an auction on placement of government bonds with a total volume of 60 billion drams was held at the Armenian Stock Exchange (AMX). At the same time, the weighted average yield of bonds amounted to 7.92%, cut-off yield – 8.08%. The annual yield of the coupon was 9%, and the maturity date was 10 years with a semi-annual periodicity of payments. The entire volume of government bonds of the AMGB1029A292 series of 60 billion drams was fully satisfied. Moreover, demand exceeded 159 billion drams, which is 166% higher than supply, which indicates the stability of financial markets and confidence in government bonds. -0-

Government Bond Allocation Auction was held Tuesday at the Armenia Securities Exchange (AMX).

According to the stock exchange’s press service, this auction was unprecedented for the amount of the allocated bonds – they totaled AMD 60bln.

The weighted average yield of bonds was 7.92%, and cut-off yield – 8.08%. The annual yield of the coupon was 9%, and the maturity date was 10 years with a semi-annual periodicity of payments.

The entire volume of government bonds of the AMGB1029A292 series of 60 billion drams was fully satisfied. Moreover, demand exceeded 159 billion drams, which is 166% higher than supply, which indicates the stability of financial markets and confidence in government bonds. -0—-