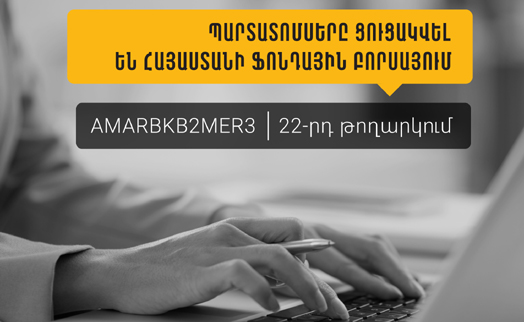

YEREVAN, June 2, /ARKA/. As reported by АraratBank, the bonds (AMARBKB2MER3) have a nominal value of USD 25, a coupon of 4.75% and a maturity of 27 months.

Coupons will be paid out every quarter. It is interesting to note that this is the 22nd current and the 14th US dollar-denominated issue of the Bank listed on AMX.

“АraratBank completed placement of its 22nd issue bonds ahead of schedule, within only 8 days. Both individuals and legal entities participated in the bond placement, which manifests the high level of credibility that the Bank has gained among its customers and investors, as well as the strong position taken by the Bank in the RA securities market. АraratBank bonds were listed on the Bbond list of Armenia Securities Exchange,” – said Anahit Shakaryan, Head of Investment Banking Department of AraratBank.

“The collaboration of the Armenia Securities Exchange and the Central Depository with АraratBank dates back to 2007. Due to the cooperation with the Central Depository, the Bank has become a link between the citizens and the Depository, mediating the registry keeping and custody services, including registration and retention of the ownership right towards securities.

The strong collaboration between АraratBank and the Securities Exchange has been gaining momentum and the results of the annual awards ceremony are its clear confirmation,” – the Bank reports. -0-