YEREVAN, March 1. / ARKA/. ARKA agency’s “Ratings” project presents stock market capitalization ranking among countries. This rating includes the countries with stock exchange trading as well as market capitalization index that is reported in the World Bank database.

In total, ARKA analytical service examined 96 countries, ranking them according to the most capitalized and non-capitalized markets. Market capitalization index is equal to the GDP percentage of the total value of free floated shares, owned by the companies, that passed a listing at the stock exchange. The indices are compiled for 2010, as there is not new data available.

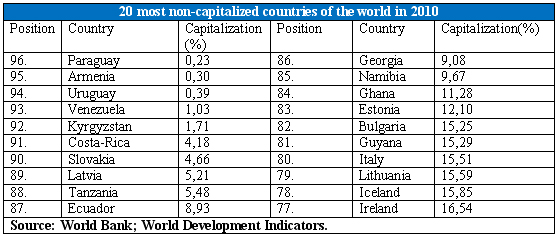

According to ARKA analysis, Paraguay has the lowest market capitalization among the other countries, total of 0.23%, appearing at the 96th position. This is explained by the fact that while managing its economy Paraguay mainly focuses on agrarian sector, which is not attractive for investors, who even ignore that Paraguay is one of the world leaders in soybean production.

Armenia, ranked 95th , follows Paraguay in the ranking. In 2010 Armenian stock market capitalization made up 0.3% of GDP. Equity market continues to remain the weakest point of Armenian financial system. This is also proven by the fact that the country’s local share market hasn’t seen any significant progress for 7 years.

Along with this, the Armenian stock market’s administration forecasts 2012 year to be a turning point for the share market due to measures planned for the companies that passed the listing

It is interesting , that the Post-soviet countries, as well as the third world and, strangely enough, Baltic and some developed states were ranked as the non-capitalized markets.

Particularly, among the developed countries Italy was ranked as 80th. Italian market capitalization makes up 15.5% of GDP. Ireland, appearing at the 77th position, has 16.5% market capitalization. And the index is not optimistic. It should be mentioned that the Irish markets hit a record downturn caused by the world financial crisis. Before the crisis, in 2007, Irish market capitalization amounted to 56% . Up to now the country is unable to recover from the shocks.

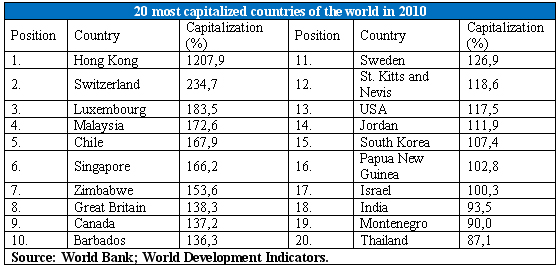

An absolute leader in market capitalization is one of the “Four Asian Tigers”- Hong Kong, the index of which is 13 times more that the country’s GDP. Two other “tigers”, Singapore (capitalization- 166.2%) and South Korea (capitalization- 107.4%) are ranked 6th and 15th respectively.

“Asian tigers” succeeded to turn into the Asian leading countries out of poor economies just within several decades . This was enabled, however, by a couple of factors, first of all a government tough economic policy and assistance provided by the developed states. “Asian tigers” followed the economic model of catching-up, and have demonstrated high rates of economic growth since the 1960s entering the list of Asian leading countries.

Switzerland took the second position in the rating. This country became famous for its transnational group of companies operating in chemical production, pharmacology, intensive farming, sustainable banking system and banking secrecy concept. Market capitalization in Switzerland makes up 235% of GDP.

Luxembourg is ranked the 3rd. Its market capitalization hits over 183% of GDP. The fact that this city-state is in top countries is not surprising, as it is one of the world’s richest cities, that attracts investors by an off-shore zone, and favorable investment and tax legislature. Per capita income, that is calculated though purchasing power parity, Luxembourg was the 3rd in the world in 2011. Malaysian market is 4th with an index of over 175% of GDP.

Finally, Chile finals top 5 countries. Its market capitalization is 167.9% of GDP.

It is interesting that top 20 countries with capitalized markets included either developed states or the third world economies. For example, Zimbabwe, which is traditionally considered to be the poorest per capita income, is ranked the 7th, ahead of the U.S., that is at the 13th position. —0–