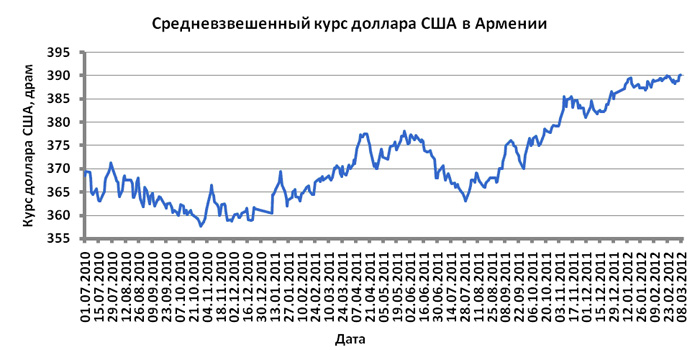

YEREVAN, March 12. /ARKA/. The average weighted exchange rate of U.S. dollar at NASDAQ OMX Armenia stock exchange rose 0.37% last week to 390.17 drams. The weekly trading amounted to 15.53 million U.S. dollars, which was 50.34% more than the previous week. The average selling rate of cash dollar rose by 0.39% to 391.44 drams on March 10.

The U.S. dollar resumed growth against dram from the first day of past week reaching 390.60 drams, a new high since May 11, 2010, on the wave of increased domestic demand for greenback as a safe-haven currency. In addition, the U.S. dollar was growing in the FOREX market due to concerns about the outcome of the Greek bonds deal.

This week the U.S. currency is likely to grow further. Nevertheless, we can not rule out a short-term downward trend because of central bank’s intervention. However, the greenback may come under pressure due to EU finance ministers’ decision on providing Greece with the first tranche of a massive bailout. This would affect the dram’s exchange rate as well. The average selling rate of cash U.S. dollar in Armenia this week is likely to be between 388.0 – 393.0 drams.

The euro exchange rate last week was determined by developments in the global FOREX market, where EUR/USD fell by 0.69% to 1.3111. The devaluation of the European currency was due to unfavorable news from the eurozone, as well as to continued uncertainty about the Greek debt write-offs.

Positive macroeconomic data from the United States, published on March 9 came as additional support for the U.S. currency. Thus, the number of new jobs in non-agricultural sector in February rose by 227,000 from 210,000 projected. As a result, the average selling rate of cash euro in Armenia past week decreased by 0.51% to 516.95 drams.

This week the exchange rate of euro will be impacted by macroeconomic statistics from the U.S. and the eurozone. We would like to single out consumer price index in the US and changes in industrial production in February, as well as the regular meeting of the U.S. Federal Reserve on interest rate. The regulator is expected to reiterate its intention to keep rates low for a long period, which may support the euro.

If the forecasts are correct, the value of euro at FOREX market is likely to rise to 1.3350. But if the economic data is negative, the euro may fall to a level of 1.2950. This is why the average selling rate of cash euro in Armenia this week will be in fluctuating between 505.0-525.0 drams.

The average exchange rate of Russian ruble past week declined by 0.37% to 13.25 drams due to falling value of ruble against the U.S. dollar. The decline was mitigated by a decrease in the value of the Armenian dram against the U.S. currency. The cost of the ruble against U.S. dollar and, consequently, the dram this week will be depending on emerging macroeconomic statistics from the U.S. and the eurozone, as well as on the dynamics of oil prices. The tense situation around Iran and high oil prices are supposed to l support the ruble. The average selling rate of cash ruble over the next five trading days is likely to be in the range of 13.10 – 13.35 drams. -0-

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.