YEREVAN, March 26. /ARKA/. Gold trading was carried out quite actively last trading week, however no price tendency was concluded. As a result gold prices recorded 1,661.61 USD dollars per troy ounce late last week, which is quite close to this indicator of the week earlier. Early this trading week gold value rose to week-maximum of 1,669.50 USD dollars per troy ounce due to strengthening of the principal currency pair on FOREX international currency market.

However, within Tuesday-Thursday gold prices were declining against the background of total tumble in prices on the markets after Eurozone and China issued weak economic data, as well as U.S. dollar continued strengthening. Significant reduction in asset volume of gold stock fund also resulted in shrinking the precious metal’s quotes. So, on Thursday, March 22, the precious metal’s quotes reached a ten-week minimum of 1,628.28 USD dollars per troy ounce.

Nevertheless, on Friday, March 23, gold quotes recovered the losses both, against the backdrop of weakening U.S. dollar, as it causes gold assets to gain attractiveness for the holders of other currencies, and vigilant purchases at lower price levels.

A slight rise or consolidation in gold prices can be expected next week as the investment and physical demand is reinforced. Resistance level for gold can be 1,685 USD dollars per troy ounce next week. At the same time strong U.S. dollar will continue halting rise in gold prices.

The main risks arising around decrease of physical demand for gold comes from India, where gold sellers are protesting against the government’s decision to increase levies from the precious metal’s trades. Apparently, the physical demand for this asset will improve its positions after the protesters stop their demonstrations.

The expected macroeconmic statistics from the USA and Eurozone can also have an impact on the precious metal’s dynamics. The main points of the American statistics are data on consumer confidence in March and final change in GDP for the forth quarter of 2011, as well as Ben Bernanke’s speech at the U.S. Federal Reserve’s conference. Amid European news we should highlight March data on sentiment index in Germany’s business, published by IFO agency.

If the economic statistic mentioned above despite positive forecast appears as negative and Bernanke’s comments disappoint the market participants once again, the gold prices may go on with dropping. Point of 1,625.0 USD dollars per troy ounce will be supporting for gold for the next five trading days.

Copper prices on the futures markets slumped 1.94% to 3,8070 USD dollars per copper pound last week. The main factor to touch off this slip is a rising alarm related to the world economy recovery and China’s economic slowdown. Unfavorable macroeconomic statistics coming from U.S. housing market was also disappointing. U.S. strong dollar continued pressuring the copper quotes.

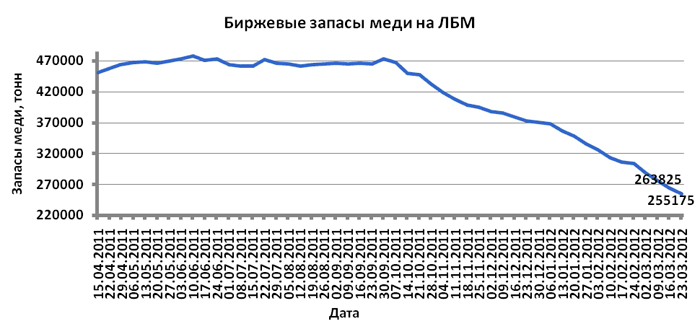

Supporting factor for the red metal was decreasing stock reserve of this asset in London Metal Exchange (LME) last week.

Next week copper dynamics will mainly depend on U.S. and Eurozone macroeconomic statistics as well as U.S. dollar’s dynamics. This statistics is expected to be moderately positive. If these forecasts are justified and data on 2011 forth quarter GDP change, sentiment index in Germany’s business environment appear as favorable, as well as Mr. Bernanke’s comments are moderately positive, prices of non-ferrous metals, including copper, may continue rising.

However, if this statistics doesn’t justify the hopes, and American dollar starts growing again, the copper prices may tumble. Anticipated fluctuation range of copper quotes on the futures market is 3.70 – 3.95 USD dollars per copper pound coming week.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.—0-