YEREVAN, May 18, /ARKA/. Armenian banks’ return on assets (ROA) index, showing a company’s efficiency in making profits from its assets, dropped to 1.66% in the first quarter of 2012, down from 2.42% in the fourth quarter of 2011, according to findings of an analysis made by ARKA news agency.

The leading bank by size of ROA indicator was Inecobank, which posted a 4.1% ROA index that was up from 3.8% at the end of the fourth quarter last year.

It was followed by HSBC Bank Armenia with a 3.95% index, down from 4.1%, Araratbank was next with a 3.64% index, up from 3.1%, Artsakh Bank with 3.3% , up from 2.72% and BTA Bank with 3.03%, up from 2.96%.

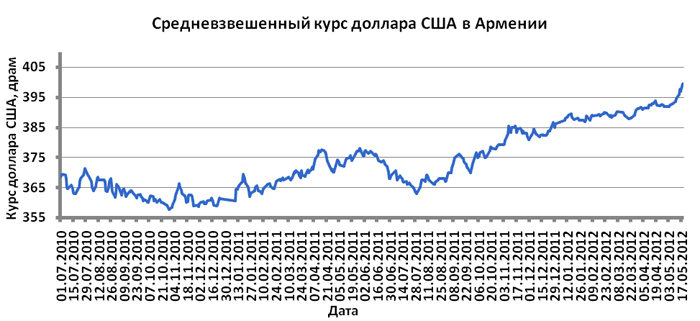

The analysis shows also that the banks’ return on equity (ROE) indicator dropped to 9.03% from 12.18% in the fourth quarter last year. In terms of ROE indicator Araratbank was the leader with a 27.19% index, up from 19.67% in the fourth quarter last year. It was followed by Inecobank with a 23.1% index that rose from 19.04, HSBC Bank Armenia with a 22.92% , down from 24.07% , Artsakh bank with a 21.27% index, up from 17.13% and Bank VTB Armenia with a 14.53%, down from 15.15%. ($1 – 396.98 drams). -0-