YEREVAN, June 18. /ARKA/. On the first day of the past week gold price was falling as the optimism sparked by reports that Spanish banks will get assistance, soon came to naught. However, from Tuesday until the end of the week investor sentiment was improving again. After an interview of Chicago Fed President Charles Evans on 12 June, who spoke in favor of easing monetary policy, hopes for new measures of quantitative stimulus increased.

Weaker-than-expected U.S. economic data also helped to strengthen investors’ hopes that the Fed will announce the launch of new measures at the upcoming meeting on June 20. Indeed, retail sales in the U.S. in May fell 0.2%, the second month in a row, while the number of initial claims for unemployment benefits totaled 386,000 versus projected 377,000.

Nevertheless, investors remained cautious ahead of planned elections in Greece, as well as the future of Spanish banking sector. Ten-year bonds’ yield in Spain rose to the psychologically important level of 7.0%, while the yield on Italian bonds repeated record highs since the beginning of the year, reaching 6.342%. As a result, the price of gold last week rose by 1.34% to 1,623.39 U.S. dollars per troy ounce.

This week an increased volatility in commodity markets is possible, including the gold market amid growing uncertainty because of repeat elections in Greece on June 17. If the right-wing New Democracy party wins the election and a real chance to form a government emerges, the price of gold may get a significant growth boost. But if the polls are won by left party Syriza the gold can break down the psychologically important level of 1,600.0 U.S. dollars per troy ounce.

A significant influence on the dynamics of the precious metal this week will come from the results of the next U.S. Federal Reserve meeting on interest rates, as recently several new measures have increased expectations of quantitative stimulus from the U.S. regulator.

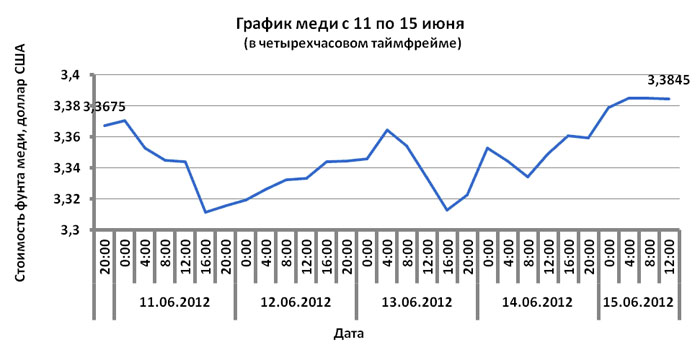

The cost of copper futures last week increased by 2.22% to 3.3845 U.S. dollars per pound due to increased hopes of a coordinated action by central banks to mitigate the monetary policy.

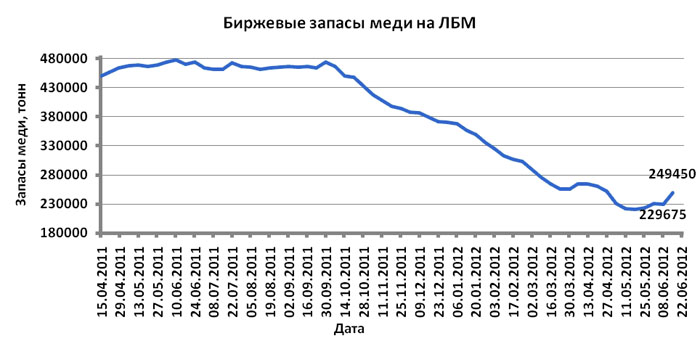

Nevertheless, investors continue to remain cautious in anticipation of the outcome of Greece elections. The likelihood of further deterioration of the financial system in the euro area may put pressure on the economies of industrialized countries and slash the demand for the metal.

Copper price this week will largely depend on developments in the euro area and the results of the next meeting of the U.S. Federal Reserve. The expected range of fluctuations in the futures market this week is 3.20 – 3.50 USD per pound of copper.

Mikael Verdyan, an analyst at Forex Club GC, specially for ARKA