YEREVAN, July 19. /ARKA/. Banks of Armenia and credit organizations of a number of other countries (Kyrgyzstan, Moldova, Tajikistan and Turkmenistan) failed to enter 2011 CIS 100 top banks rating compiled by RIA Rating agency.

In spite of the growth in assets reported by the five largest banks of Armenia in 2011, it was still lower than it is required to enter the rating list.

The assets of the largest Armenian bank ACBA-CREDIT AGRICOLE jumped by 30.1% to 218.6 billion drams ($567.6 million) at the end-2011. At the same time the minimal benchmark necessary to enter the rating climbed by 19% in 2011 to $2.12 billion. Thus, in order to be listed in top 100 banks of CIS the largest Armenian bank will have to surge its assets by $1.55 billion.

The rating analysts suppose that in a mid-term perspective the Armenian and Moldovan credit organizations have all the theoretical chances to enter the rating list. This process can be accelerated if some large national financial institutions consolidate, they imply.

According to the agency, out of 1,4 thousand banks all over the CIS, the banks of just seven countries entered the rating, as a year earlier: Azerbaijan, Belarus, Georgia, Kazakhstan, Russia, Uzbekistan and Ukraine. Georgian banks were considered for the rating even though Georgia had withdrawn from the CIS in 2009, as they have very close ties with CIS banks. The list of countries didn’t change from the last year.

Total assets of 100 largest banks made $1.23 trillion as of January 1 of 2012, higher by 12.5% from a year earlier, according to the agency. The dynamics has slightly deteriorated from 2010 when the growth in assets was 15%. Of all 100 banks, 81 banks reported growth, and 19- drop in assets.–0–

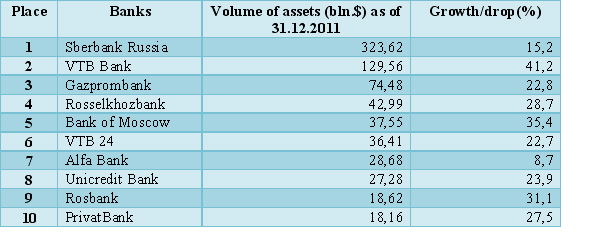

Top 10 banks of the CIS according to RIA Rating