YEREVAN, July 30. /ARKA/. Gold prices sharply slashed last week amid the concerns around Spain and Greece.

Yield of Spain’s 10-year-old government bonds rose to the highest notches in the history of the country’s eurozone membership thus implying that Spain may require the full aid package. As a result market members preferred the U.S. currency pressuring gold quotes.

Nevertheless, on Tuesday, July 24, and up to the week’s out gold not only rallied but also reached the new 5-week maximum of 1,629.22 USD per troy ounce amid the restoration of the main currency pair and new hopes for measures by the Federal Reserve to stimulate economy. Moreover, comments made by Ewald Nowotny, the European Central Bank member, on the possibility to give banking license to ESM foundation confirmed by the ECB chairman Mario Draghi prompted jump in gold prices.

As a result, gold prices climbed by 2.64% to 1,622.34 USD per troy ounce last week.

This week, the United States will release a number of important macroeconomic data which can significantly influence the sentiments of the investors and, thereby, gold prices. It is necessary to pay attention to PMI index from Supply Management Institute in industrial sector, the number of new jobs from ADP and the employed in non-agricultural sector agency in July.

The expected moderately positive statistics may foster gold surge. Gold prices may reach maximum of 1,680.0 USD per troy ounce this week. Nevertheless, extremely positive data from the United States may result in new concerns related to the further stimulating measures by the Federal Reserve, and enhance the American currency’s position. The market members will also concentrate on the meeting of Federal Reserve on interest rate. Supporting benchmark for gold will be 1,560.0 USD per troy ounce this week.

Of European news we should focus on separate data of PMI in July, and the next meeting of ECB on interest rate as well as a traditional press conference of its chairman Mario Draghi. We don’t expect the ECB to reach any surprising decisions around monetary policy, and this, in turn, will not pressure gold quotes.

Last week copper prices reported 3.4320 USD per pound.

Early last week copper prices went down amid the debt crisis in the eurozone. Weak economic data from Germany and China also pressured the quotes. Indeed, data from Germany reported slip in processing industry this month. Preliminary PMI dropped to thirty seven of the month minimum of 43.3. Business environment conditions from IFO fell to 103.5 versus 105.2 in July from June, and PMI of China compiled by HSBC reached again 49.5 signaling about decreasing activity in processing industry.

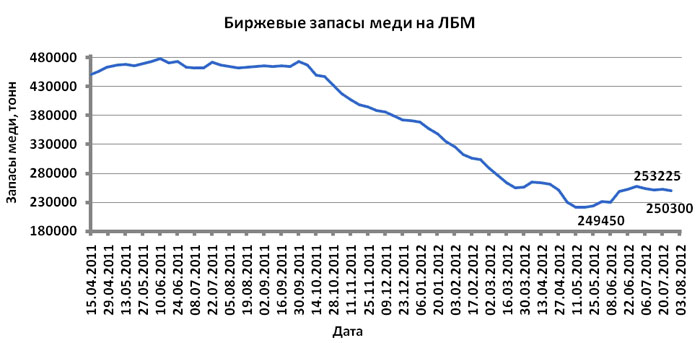

However, later that week copper prices could rally. Additional supporting factor for copper quotes was decreasing stock reserves of the asset at London Metal Exchange (LME).

Copper dynamics this week will depend on the macroeconomic statistics from the United States, eurozone and China, as well as the American currency. The statistics is expected to be moderately positive. If these forecasts come true and PMI for industrial sector of the U.S. and China as well as numbers from the U.S. labor market are moderately positive, non-ferrous metals, including copper, may rally.

However, if the statistics is disappointing and the American currency starts growing again, copper prices may fall. The market members will also concentrate on the Federal Reserve’s next meeting. The expected fluctuation range for copper quotes this week is 3.28 – 3.57 USD per copper pound.

Mikael Verdyan, analyst at GK FOREX CLUB, specially for ARKA

The opinion of the author may not necessarily reflect the opinion of ARKA.—0