YEREVAN, July 30. /ARKA/. Last week the U.S. dollar’s average weighted exchange rate at NASDAQ OMX Armenia stock exchange dropped by 1.15% to 407.25 drams with weekly trading amounting to USD 18.30 million, almost four times more than the previous week. The average selling rate of cash dollar fell 79% to 409 drams on July 28. The drop in greenback’s value was due to the decrease of the U.S. dollar in the FOREX market against a background of growing hopes for new stimulus measures by the U.S. Federal Reserve in view of deteriorating global economic outlook.

This week U.S. dollar exchange rate in Armenia might remain under pressure because of the growing likelihood that the U.S. regulator will have to once again resort to unconventional measures to enhance the national economy. Indeed, the latest statistics from the U.S. confirms this scenario.

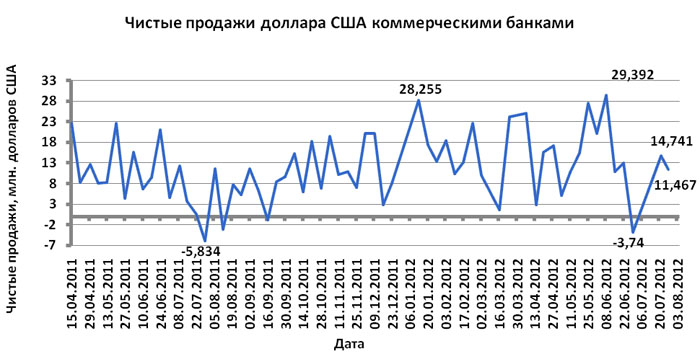

The U.S. dollar’s value will be falling also because of lowering volume of purchases by individuals and businesses. According to the Central Bank of Armenia, local banks sold a total of 11.467 million U.S. dollars last week, which was 22.21% less than the previous week. The average selling rate of cash U.S. dollar in Armenia this week will likely be in the range of 406.0 – 411.0 drams.

Early last week, the single European currency traded lower against the backdrop of growing concerns about Spain and Greece. The growing yield on ten-year Spanish government bonds to the record highest levels increased concern that Spain may need a new package of financial assistance prompting market participants to choose the U.S. currency. But on Wednesday, July 25, the single European currency managed to recover its losses against the backdrop of escalating expectations for new stimulus measures by the U.S. Federal Reserve in view to deteriorating global economic outlook. Furthermore, additional support for the euro came from ECB representative Ewald Nowotny who said that the ECB was considering granting a banking license to ESM Fund and from comments of ECB chairman Mario Draghi, who confirmed the willingness of the ECB to act. As a result, the average selling rate of cash euro in Armenia last week rose by 0.93% to 505.74 drams.

This week, the dynamics of the euro in the world and, accordingly, in Armenia will be determined by news from the international markets. In this regard, the average selling rate of cash euro will probably will be within 495 – 515 drams.

The average selling rate of cash Russian ruble last week declined by 1.08% to 12.83 drams due to a sharp decrease in the value of the ruble against the U.S. dollar in the first half of last week because of bad news from Greece and Spain, as well as the growth of Armenian dram against the U.S. dollar.

The cost of ruble against USD this week will be depending on U.S. macroeconomic statistics and eurozone. This and other developments in view the average selling rate of the ruble in Armenia is likely to be in the range 12.70 – 13.00 AMD.

Mikael Verdyan, an analyst for FOREX CLUB, specially for ARKA.

The opinion of the author may not necessarily represent those of the agency.