YEREVAN, August 14. /ARKA/. Last Monday gold prices went up amid the positive expectations that the ECB may launch additional measures for European economy aid. Indeed, ECB Governing Council member Ardo Hansson’s comments about the “significant” volume of bond-buy, encouraged the market members. Moreover, the growth of the principal currency pair also raised demand for the precious metals.

However, since Tuesday and till the week’s out, gold prices were teetering due to lack of economic data. Trades were also low touched off, in our opinion, by the seasonal factors.

Nevertheless, on Friday, August 10, gold quotes rose as the USA published weak data on import price index. As a result, the investors hoped the Federal Reserve will launch new stimulation measures of the American economy. Thereby, gold prices rose by 0.89% to 1,619.48 USD per troy ounce last week.

This week, the United States and Eurozone will publish some important macroeconomic data, that can have a significant impact on investors’ sentiments and gold cost. Of American news we should highlight industrial production, consumer inflation, housing market, as well as the number of long-term American securities bought by foreign investors in June. The expected moderately positive statistics from overseas may support gold quotes. The resistance level for gold this week will be 1,635.0 USD per troy ounce.

Of European news we should focus on consumer inflation in July and business sentiment index in Germany by ZEW institute in August, as well as preliminary data on Eurozone’s GDP in the second quarter. The weak economic statistics from the region will pressure the gold quotes. The supporting benchmark will be 1,600.0 USD per troy ounce this week.

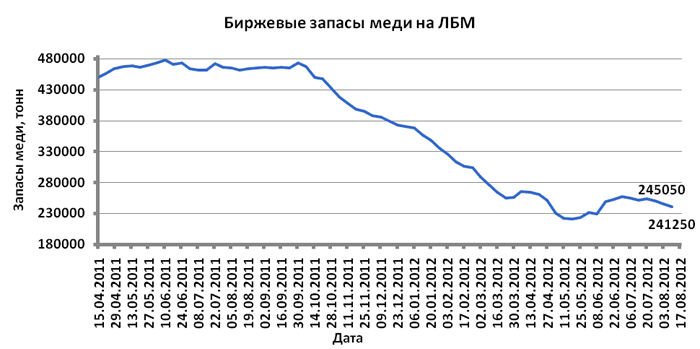

Copper prices climbed 1.12% to 3.4015 USD per pound last week due to expectations that the ECB will soften its monetary-credit police.

Nevertheless, the copper quotes were pressured by the weak economic data from China and concerns around economic perspectives of the Eurozone. Indeed, industrial production in China rose by 9.2% against the projected 9.7%, foreign commerce has also reported lower data than expected. The positive balance shrank to 25.1 billion dollars in July from 31.7 billion USD in June. Export surged just by 1.0% whereas many experts expected 8.0% growth. Import increased by 4.7% falling short of some analysts’ expectations of 7.0% rise.

The decreased stock reserve of this asset at London Metal Exchange also fostered copper quotes increase last week.

Copper dynamics this week will depend on macroeconomic data from the U.S. and Eurozone, as well as the U.S. currency dynamics. This statistics is expected to be moderately positive. If the forecasts come true, and the industrial production, housing market data from the U.S. and business sentiment index of Germany are moderately positive, non-ferrous metals, including copper, will continue growing in price.

However, if the statistics is different, and the American currency continues rising, copper quotes may fall. The expected fluctuation range at the market this week is 3.33 – 3.47 USD per pound.

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency. -0-