YEREVAN, October 8. /ARKA/. Early last week gold prices were teetering amid the investors’ concerns about a regular session of the European Central Bank, as well as data from the U.S. labor market. Furthermore, the rooted uncertainty in Europe, and the global economic conditions didn’t cast any optimism suppressing the activity of the market members instead.

On Monday, during the Asian trading week, gold quotes tumbled reaching a week minimum. This happened amid the weak data coming from China’s manufacture sector.

However, later the comments by President of the Federal Reserve Bank of Chicago Charles Evans offset the negative impact of the Chinese data. Mr. Evans said the American regulator will continue implementing its quantitative easing program in 2013 too.

The press briefing of ECB Chairman Mario Draghi, on October 4, resulted in gold prices’ hike. He highlighted the pessimistic economic prospects, and assured that the Central bank is ready to buy the bonds of the eurozone’s countries in trouble. The rise of the principal currency pair also prompted increase in the gold cost. As a result, gold quotes rose to 1,795.57 USD per troy ounce, which is a record since mid-November of 2011.

Nevertheless, at the end of the week, this asset started slashing again as the U.S. labor market issued some positive data. The unemployment rate in September slipped to 7.8% against the projected 8.2%. As a result, the gold cost increased by 0.83% to 1,780.19 USD per troy ounce.

Early this week, the gold prices are expected to consolidate. Moreover, the U.S. will have holiday on the first trading day, which will also have some impact on the market activity. We expect the investors to continue waiting for the situation around the eurozone debt crisis to stabilize, particularly, in Spain, as Eurogroup meeting is scheduled for Monday. Any certainty here can support the quotes of the precious asset in a short-term perspective. The gold prices may reach 1,803.0 USD per troy ounce within the next five days.

The macroeconomic statistics from the U.S. and eurozone may also impact the gold dynamics this week. Of the American news we should focus on industrial prices index in September, Beige Book, as well as the number of submitted unemployment allowance applications last week. Of the European news we should highlight the final report on consumer inflation in Germany in September, the eurozone’s industrial production index, and the ECB’s monthly newsletter.

If the economic statistics from overseas is better than projected, and the data from the eurozone are unsatisfactory, the gold cost may slip. The supporting level for gold may be 1,755.0 USD per troy ounce this week.

The copper cost rose by 0.11% to 3.7575 USD per pound. The highest jump copper reported on Monday, October 1 due to the comments by the Federal Reserve Bank of Chicago President Charles Evans.

Weak data from China’s manufacture activity raised more concerns around the global economic perspectives, thus pressuring copper prices. Indeed, according to the data, PMI for manufacture sector of China rose to 49.8 in September against 49.2 in August, which is still lower than 50.0.

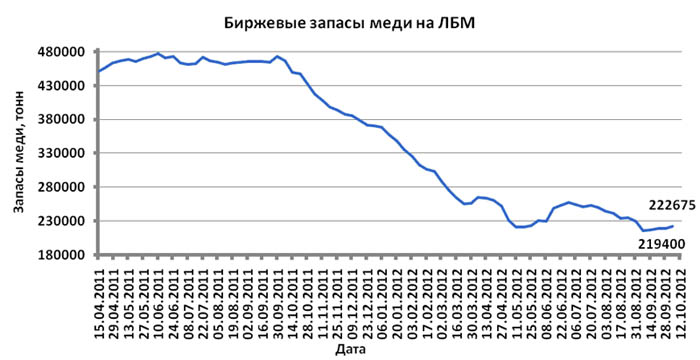

The increased reserve of this asset at London Metal Exchange also had a negative impact on copper prices.

This week copper dynamics will mainly depend on the macroeconomic data of the United States, eurozone and China. Moderately positive data from overseas may support the copper quotes, whereas the weak statistics from the eurozone will hinder the prices from rising. Investors will be also interested in foreign trade and industrial production of China for September, and the expected weak data may foster tumble in copper prices.

However, if this statistics is better than expected and the principal currency pair continues growing, the copper prices may get a significant impetus for increasing. The expected fluctuation range for copper prices is 3.68 – 3.85 USD per copper pound.-0-

Mikael Verdyan, an analyst at FOREX CLUB, specially for ARKA news agency.

The opinion of the author does not necessarily reflect that of the agency.