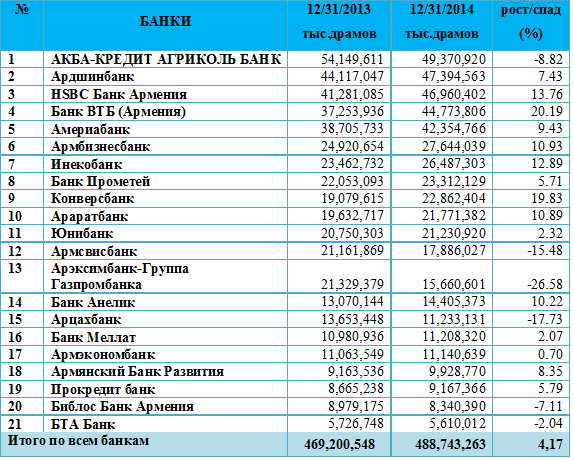

YEREVAN, February 16. / ARKA /. ARKA News Agency has released a fresh ranking of 21 commercial banks operating in Armenia by size of their capital as of late 2014.

The ranking is interesting in the context of a latest decision of the Central Bank of Armenia to raise the minimum amount of commercial banks’ total capital to 30 billion drams from the current 5 billion drams from January 1, 2017.

According to 2014 data, the total capital of only five Armenian banks met and even exceeded the new requirement, while four banks’ capital was below 10 billion drams. Another 12 banks’ capital ranged from 10 to 30 billion drams. It turns out that 16 banks have two years ahead to meet the new requirement.

According to ARKA’s ranking, the aggregate capital of all 21 Armenia-based commercial banks stood at about 488.7 billion drams, having increased by 4.17 percent from the previous year.

The largest five banks in terms of capital were ACBA-CREDIT AGRICOLE BANK, Ardshinbank, HSBC Bank Armenia, VTB Bank (Armenia) and Ameriabank, which had a total of 230.8 billion drams of capital (47.2 percent of the total).

ACBA-CREDIT AGRICOLE BANK’s capital stood at 49.4 billion drams. Its share in the aggregate capital was 10.1 percent, although its capital slashed by 8.82 percent from 2013. It was followed by Ardshinbank with 47.4 billion drams (an increase of 7.43 percent since the beginning of the year). It accounted for 9.7 percent of the total.

HSBC Bank Armenia with a capital of about 47 billion drams (an increase of 13.76 percent) was third. Its share of the total capital was 9.6 percent.

The fourth position in the ranking was held by VTB Bank (Armenia) with a capital of about 44.8 billion drams (a growth of 20.2 percent). It accounted for of 9.2 percent of the total.

The fifth bank by size of capital was Ameriabank with 42.3 billion drams (up 9.43 percent). Its share of the total was 8.7 percent.

The ranking shows that VTB Bank (Armenia) increased its capital last year by about 20.2 percent, the largest increase, while Areximbank-Gazprombank Group saw its capital slash by 26.6 percent from 15.7 billion drams in late 2013.

BTA Bank’s capital decreased by 2.04% to about 5.6 billion drams. Its share in the total was 1.1 percent.

The ranking was compiled based on Bank of Armenia quarterly bulletin of ARKA news agency for the 4th quarter of 2014. -0-