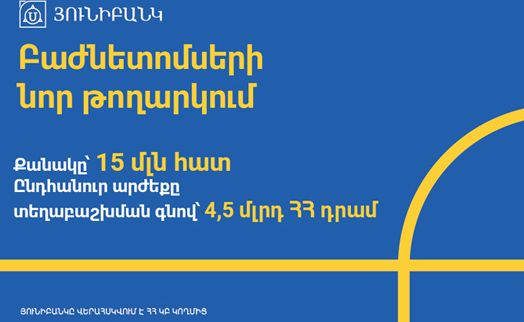

YEREVAN, May 12. /ARKA/. Unibank CJSC has announced a new issue of shares. The bank said it plans to place 15 mln common non-documentary shares worth 4.5 billion drams by means of public offering.

Unibank’s press service said in order to acquire shares one should visit its head office or one of its 54 branches. The minimum stake is worth 1,000,200 drams. Shares can be purchased by both individuals and legal entities. The market maker is Armbrok firm.

The shares will be listed at the Armenian Securities Exchange, which increases their attractiveness, since the income raised from securities is not taxed.

With this new issuance of shares, Unibank continues its strategy of becoming a people’s bank, involving broad sections of the population in its management, thus becoming more effective and transparent. Acquisition of shares of a reliable and stable bank is one of the ways to make long-term and profitable investments and savings.

Today Unibank has over 180 shareholders. Holders of Unibank shares enjoy preferential service conditions: 25% discount for tariff services, higher deposit rates and more favorable crediting terms.

The public offering prospectus was registered by the Central Bank of Armenia on 03.05.2023 in accordance with its decision № 1/226A.

The investor may buy the prospectus and the enclosed documents at the head office of Unibank or at its branches. The electronic copy is available on the web-site of the bank at www.unibank.am.

Public offering of shares was announced on the 3rd working day after registration of the prospectus by the Central Bank and will last 22 working days. The starting date of the placement will be published on the bank’s web site at least 3 business days in advance.

Unibank has conducted a total of 6 share issues. In 2022 Unibank was recognized the Best Equity Underwriter in Exchange’s Corporate Securities Allocation System.

As per the results of 2022, Unibank achieved positive financial results in all the main directions of its activity and secured profit of about AMD 4.4 billion. Unibank was the leading bank in 2022 by the number of consumer loans.

Unibank’s private banking Prive was recognized the Best Domestic Private Bank in Armenia by the Euromoney Global Private Banking Awards-2023. –0—