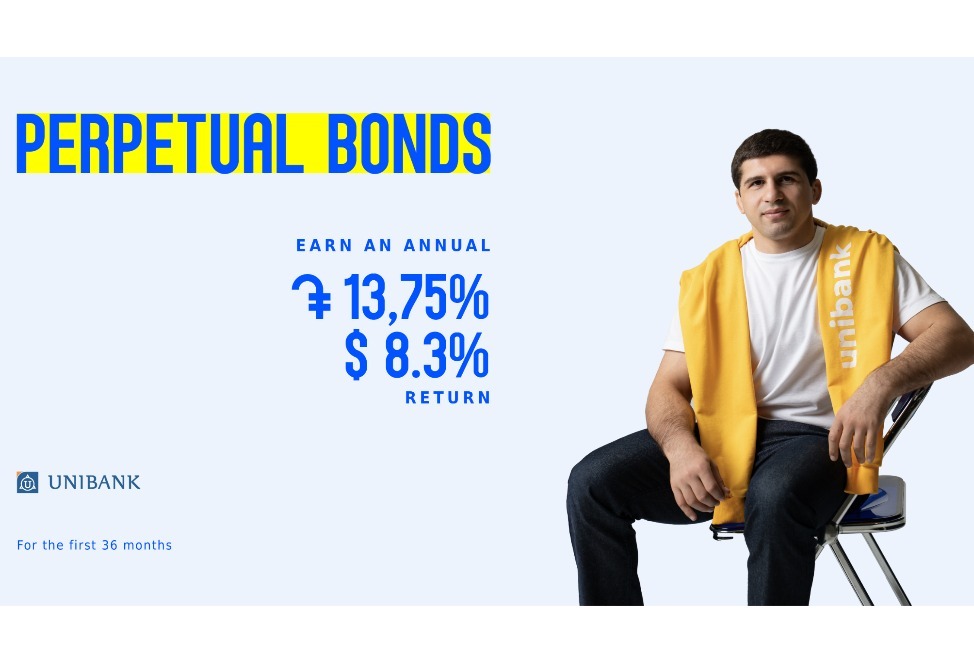

YEREVAN, December 4. /ARKA/. Unibank announces the placement of the first perpetual bonds in the Armenian market, with a total volume of AMD 3.5 billion and USD 9 million. The coupon yield is set at 13.75% perannum for the AMD-denominated bonds and 8.3% per annum for the USD-denominated bonds.

The issuance of this new instrument marks an important milestone for Armenia’s capital market, offering investors an opportunity to receive long-term, regular income. The yield on perpetual bonds significantly exceeds that of traditional issuances, making them particularly attractive to investors seeking extended cash flows.

Coupon payments will be made quarterly. During the first three years, the yield will remain fixed; thereafter, it will be recalculated based on the 90-day SOFR rate plus 4% for USD bonds, and for AMD bonds—based on the three-month government bond yield curve plus 6.5%. After the fifth year, the bank may exercise its call option and redeem the bonds at par value.

Unibank is one of the most active participants of the stock exchange and continues to act as a pioneer among corporate issuers, introducing new financial instruments to the Armenian capital market. As of today, the bank has placed 26 bond issuances, including the country’s first subordinated bond issue, successfully placed among a broad base of investors. This demonstrates the high level of confidence in the bank and the willingness of clients to invest in Unibank’s securities.

The Prospectus of the perpetual bonds (registered by the Central Bank of Armenia on 26.11.2025 under Decision No. 1/427A) is published on the bank’s website: www.unibank.am