YEREVAN, December 3. /ARKA/. Last week the gold quotes were pressured amid the political battles between the U.S. legislators. Gold quotes didn’t get any support as the international creditors of Greece had finally reached an agreement regarding the financial aid.

As a result, gold prices tumbled to the new two-week minimum of 1,705.73 USD per troy ounce.

The U.S. budget “breakdown” was of the utmost interest among the investors this week. The contradictory comments of the political leaders about reaching a possible agreement encouraged the market dealers to buy the USD. Optimistic data on macroeconomic indicators, unemployment allowance applications and GDP of the U.S. have also curbed gold prices from growing. Thus, the gold cost dropped by 2.10% to 1,713.28 USD per troy ounce within the last five days.

This week, gold cost down or consolidation may continue as the strong economic data from the overseas have significantly raised concerns of the investors over the third round of the American economy stimuli measures. Gold cost dynamics will again depend on the U.S. data and its “budget breakdown” progress. The supporting benchmark for the gold will be 1,700.0 USD per troy ounce this week. Gold prices may also fall to 1,672.0 USD.

Gold dynamics will depend on the macroeconomic statistics from the U.S. and the eurozone. Of the American statistics we should focus on PMI for industrial sector published by Institute for Supply Management, a number of new job openings by ADP agency and the change in the number of the employed in the non-agricultural sector in November. The expected pessimistic data from the labor market may weaken the USD positions and support gold prices up. The resisting benchmark this week may be 1,735.0 USD per troy ounce. If the statistics is quite better than has been forecasted, gold cost may fall.

Of the European news we should highlight Europe’s reviewed GDP data in the third quarter, another meeting of the ECB on interest rate and the traditional press conference of the ECB chairman Mario Draghi scheduled for December 6, Thursday. We believe, the European regulator will not make any surprising decisions related to monetary policy. However, if Draghi points to pessimistic prospects of the European economy and confirms the European Bank is inclined to softer monetary and credit policy, the gold quotes may rise. The weak economic data from the eurozone and shaky economy of the region also imply the ECB is likely to conduct soft monetary and credit policy.

Copper price last week rose 2.58% to 3.6185 USD per pound. Copper trades were not regular amid the ongoing U.S. budget talks between the White House and the Congress.

The highest jump the copper quotes demonstrated on Thursday and Friday as the strong macroeconomic statistics from the overseas strengthened demand for the asset. Indeed, the U.S. economy reported the highest over three years growth rates in the third quarter. U.S. GDP in the third quarter rose 2.7% per annum. U.S. President Barack Obama expressed his hopes that the White House and the Congress can resolve the tax and budget issues by the Christmas. This fact supported the copper quotes.

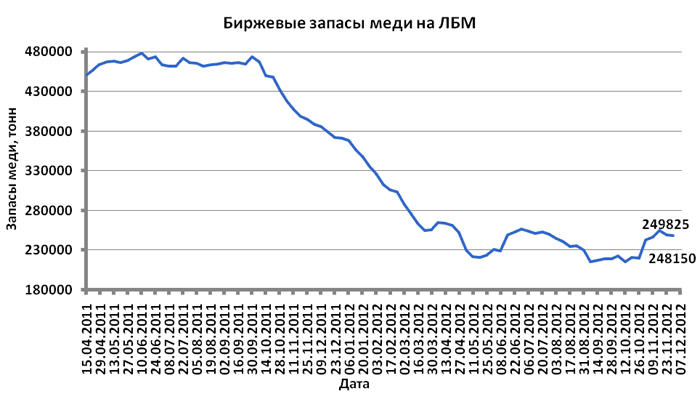

The decreased reserve of this asset at London Metal Exchange also fostered hike in copper quotes.

This week copper dynamics will mainly depend on the macroeconomic statistics of the United States, eurozone, China and the USD positions. The American statistics is expected to be pessimistic, thus copper prices will grow.

The anticipated fluctuation range for copper is 3.52–3.70 dollars this week. —0–