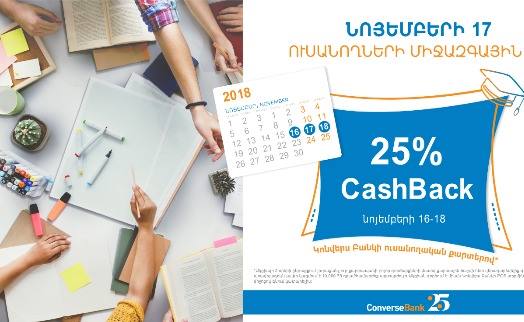

YEREVAN, November 15. /ARKA/. On the eve of the International Students Day, Converse Bank said it is launching another loyalty campaign – the Bank’s student cardholders can benefit from the opportunities offered by the announced CashBack campaign.

“Within the framework of the campaign, on November 16-18, the Bank offers its student customers to make non-cash purchases via Converse Bank’s POS terminals using the Bank’s Student, Visa ISIC cards and the plastic cards provided within the framework of Create Your Credit History campaign, and get CashBack equivalent to 25 percent of the transaction(s) amount”, – they said at the Bank, adding that this year more than AMD 10 million has been returned to customers in total.

It was also mentioned at the Bank that tomorrow, on November 16, the results of the campaign Create Your Credit History conducted for students will also be summarized. Within its framework, the students who have made non-cash purchases with the Bank’s cards for the amount of AMD 100,000 and more will get gifts, as well as the opportunity to apply for the Bank’s mortgage loans on preferential terms and get practical training at Converse Bank.

It should be mentioned that eligible participants of Create Your Credit History campaign are the students of the higher educational institutions covered by the Student Lending Program, as well as 12th-grade adult students and alumni of Ayb and Shirakatsy Lyceum educational complexes.

Within the framework of the campaign, until December 30, the beneficiaries will be provided with MasterCard Standard plastic cards with credit limit at 36 months maturity and 15 percent annual interest rate, without a service fee.

Converse Bank was registered on December 20, 1993. The bank’s shareholders are Advanced Global Investments” LLC (Argentina) with 80.94%, Armenian Apostolic Church with 5% and HayPost Trust Management B.V. Company with 14.06%. -0—