YEREVAN, March 28. /ARKA/. Interest rates on dram deposits at Armenia’s banks remain down.

According to the latest reports of the Central Bank of Armenia, the average rate on up-to-12-month deposits in Armenian drams stood at 8.73% in February 2018 – 0.55 percentage points lower than it was in February 2017.

Rates have been going down since 2016, when the central bank decided to ease its monetary policy. In March 2017, the regulator ceased relaxing its monetary policy and set the key rate at 6%.

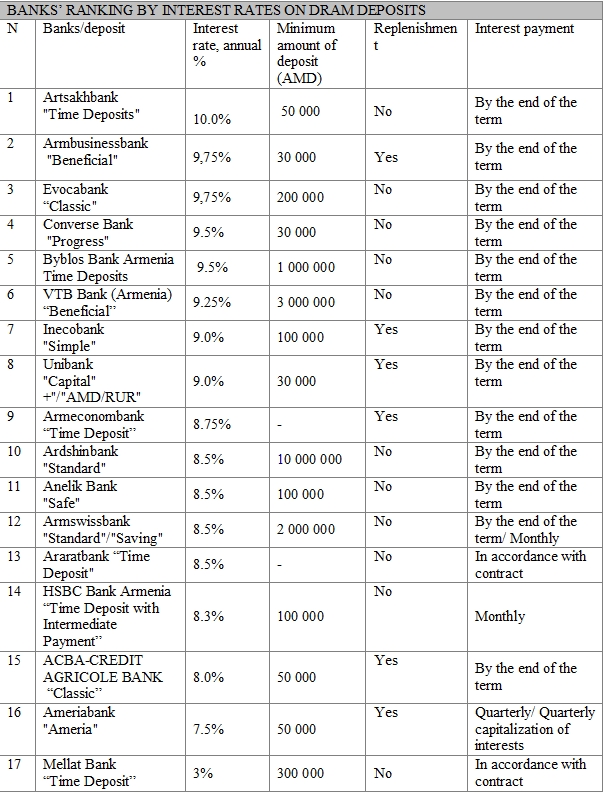

ARKA News Agency is presenting the ranking of the most lucrative interest rates on dram deposits at Armenia’s banks. The ranking is based on the analysis of the market, figures from the commercial banks’ official websites as of March 2018.

One-year individual time deposits with the highest interest rates have been included in the ranking.

Neither amounts of deposits nor interest payment schemes and ways to replenish deposits have been considered.

The raking is topped by Artsakhbank, Armbusinessbank, Evocabank, Converse Bank and Byblos Bank Armenia.

The market analysis shows that the maximum annual interest rate on deposits is 10% now. This interest rate is offered by Artsakhbank on “Time Deposits”.

Armbusinessbank and Evocabank share the second and third ranks. Both banks attract deposits at a 9.75% annual interest rate.

Two other banks – Converse Bank and Byblos Bank Armenia, with their 9.5%, came fourth and fifth in the ranking.

Mellat Bank is singled out for the lowest interest rate – 3%.